Five considerations when renewing employee benefits insurance

January 9, 2023

Benefits Package to Attract & Retain Employees in Singapore

January 9, 2023Company Employee Benefits Policy In Singapore

Employee Benefits

Company Employee Benefits Policy In Singapore

January 9, 2023

Employee benefits plan is an essential component of a complete compensation package. This is because they provide a safety net for workers and their families if something goes wrong.

Regardless of size or industry, company employee benefits policies should exist to safeguard their staff from unforeseen events and help them succeed at work.

But what employee benefits should you provide?

This article will cover some of the most crucial employee benefits policies you need to know as an employer in Singapore and inspire you with dozens of supplementary benefits.

What Are Employee Benefits?

Employee benefits are, simply put, compensation that employers offer their workers to reward them. This includes bonuses and allowances in addition to non-cash perks like insurance or leave.

What Are The Mandatory Employee Benefits In Singapore?

The Employment Act is Singapore's main labour law. It provides basic terms and conditions at work for workers covered by the act.

Before we get into the nitty-gritty, it's crucial to know who is covered by the Employment Act.

Who is covered and not covered by the Employment Act?

Workers who are covered by the Employment Act are local or foreign employees contracted under an employer (including full-time, part-time, temporary, and contract workers) and paid by either hourly, daily, monthly, or piece-rated.

Note: If your people are working less than 35 hours a week, they're categorised as part-timers and their employment T&Cs are listed in Employment of Part-Time Employees Regulations.

The Employment Act does not cover some workers. In this case, their work T&Cs should follow their employment contract. They are:

- Seafarer

- Domestic worker

- Statutory board employee or civil servant

Here comes the interesting part. Part IV of the Employment Act has unique coverage.

(In case you're wondering, Part IV is where it contains hours of work, overtime pay, and rest days.)

Not every employee is covered by Part IV. The eligible employees are:

- A local or foreign workman doing manual labour earning a basic monthly salary of less than $4,500

- A local or foreign employee who is not a workman, but who is covered by the Employment Act and earns a monthly basic salary of less than $2,600.

Now that we've understood who is covered and who's not, let's dive into the mandatory and supplementary benefits.

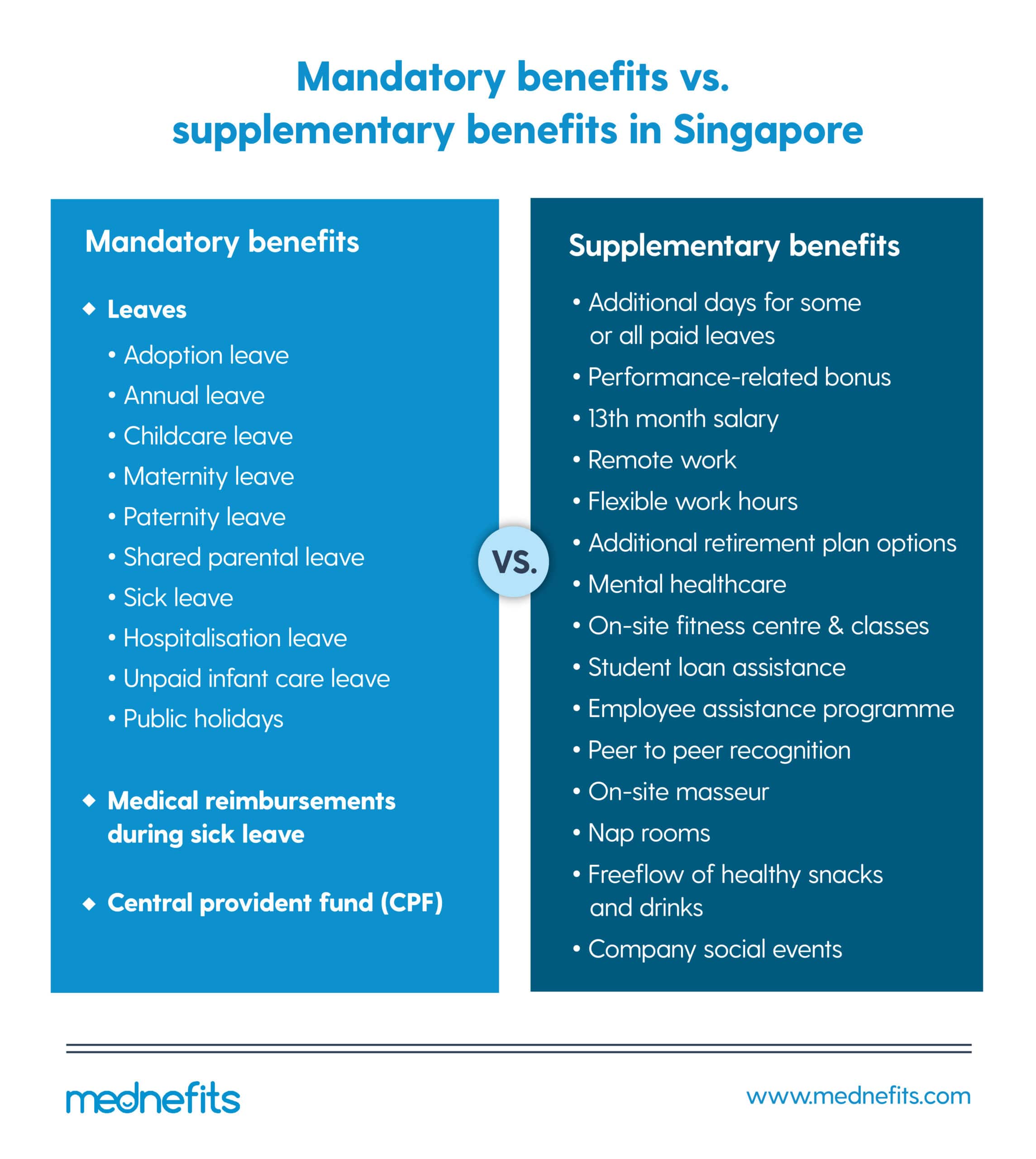

Mandatory Benefits

- Adoption leave: Mothers with adopted children aged less than 12 months are entitled to 12 weeks of paid adoption leave. One of them must be a Singapore citizen. They must have served the employer for at least 3 continuous months to be eligible.

- Annual leave: Employees who have worked with you for more than 3 months are eligible for 7 - 14 days of annual leave (depending on the year of service).

- Childcare leave: Eligible working parents of Singapore citizen children are entitled to 6 days of paid childcare leave per year. If the child is a non-citizen, parents can get 2 days of childcare leave a year.

- Maternity leave: Working mothers are entitled to either 16 weeks of Government-Paid Maternity Leave or 12 weeks of maternity leave, depending on whether your child is a Singapore citizen and other criteria.

- Paternity leave: The Working fathers are entitled to 2 weeks of paid paternity leave funded by the Government.

- Shared parental leave: Working fathers can apply to share up to 4 weeks of their wife’s 16 weeks of Government-Paid Maternity Leave (with their wife's permission, of course).

- Sick leave: The number of days of paid sick leave depends on the employee's period of service, up to 14 days for outpatient sick leave and 60 days for hospitalisation leave. The 60 days of hospitalisation leave includes the 14 days of outpatient sick leave.

- Unpaid infant care leave: Each parent is entitled to 6 days a year of unpaid infant care leave, regardless of the number of children.

- Public holidays: All employees are entitled to 11 paid public holidays. If you want them to work on public holidays, you're required to pay them an extra day's salary or grant them an off day(s).

Mandatory Benefits: Part IV of the Employment Act

- Work hours: Up to 44 hours a week, and the maximum work hours is 12 hours a day

- Overtime pay: Pay at least 1.5 times the hourly basic rate of pay. Payment must be made within 14 days after the last day of the salary period.

- Rest day: You must provide 1 rest day a week

Mandatory Benefits: Central Provident Fund (CPF)

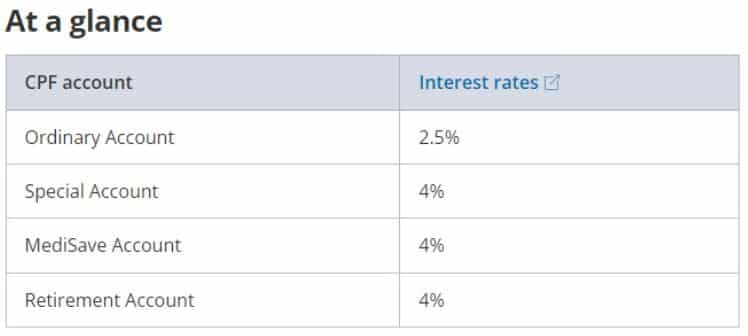

The CPF is a mandatory social security savings scheme funded by contributions from employers and employees.

The CPF is a key pillar of Singapore’s social security system, and serves to meet our retirement, housing and healthcare needs.

The government also helps to supplement the CPF savings of lower wage workers through schemes such as Workfare and top-ups to MediSave for senior citizens.

Medical Reimbursements During Sick Leave

- If your employees take paid sick leave during working days, you’re required to pay their salary

- Additionally, if their MC is issued by a medical practitioner from a public institution or appointed by your company, you also need to reimburse the medical consultation fees.

- Learn more about medical reimbursements and salary during sick leave here.

What Are The Supplementary Employee Benefits In Singapore?

- Additional days for some or all paid leaves

- Performance-related bonus

- 13th month salary

- Insurance (medical, dental, vision, life, accidental death, disability)

- Remote work

- Flexible work hours

- Additional retirement plan options

- Mental healthcare

- On-site fitness centre and classes

- Student loan assistance

- Employee assistance programme

- Peer to peer recognition

- On-site masseur

- Nap rooms

- Freeflow of healthy snacks and drinks

- Company social events

Which Supplementary Employee Benefits Should You Provide?

This is one of the most challenging puzzles to solve when planning for your company.

While it's easy to think of solutions from your perspective, try something different this time.

Create conversations with your employees and genuinely ask them about what they think about your employee benefits package. Most companies start this process through a benefits sentiment survey.

Doing this builds trust and loyalty among your employees and fully utilises your budget on benefits that matter.

Finding out the most important benefits for your employees is going to take time and effort. But the prize at the end of the tunnel is extremely rewarding.

Companies that have done this are enjoying higher productivity, increased bottom line, stronger trust and loyalty, better engagement, lower turnover rate and more.

Well, if you're still not sure whether you want to commit to 'finding out the most important benefits' process or not, you can look at this survey that has listed the top employee benefits that attract and retain talents in Singapore.

About Mednefits:

Mednefits helps businesses take care of their employees with its automated, affordable, and accessible employee benefits platform.

Request to join Mednefits for free to help process and track claims in real-time, while controlling costs.