Careers at Mednefits | Customer Support Executive

March 17, 2025Rising Health Insurance Premiums? Here’s How to Navigate It

General

Rising Health Insurance Premiums? Here's How to Navigate It

April 9, 2025

Malaysia and Singapore have recently seen significant increases in employee health insurance premiums, prompting concern among employers and employees. Many organisations are considering scaling back health insurance benefits to manage rising costs.

Bank Negara Malaysia has capped annual premium increases at 10% for at least three years to alleviate financial pressure on policyholders. Meanwhile, Singapore expects medical cost inflation to stabilise at 12% in 2025.

Despite these measures, SMEs still face financial strain from rising premiums, highlighting the need for cost-effective strategies to manage these expenses.

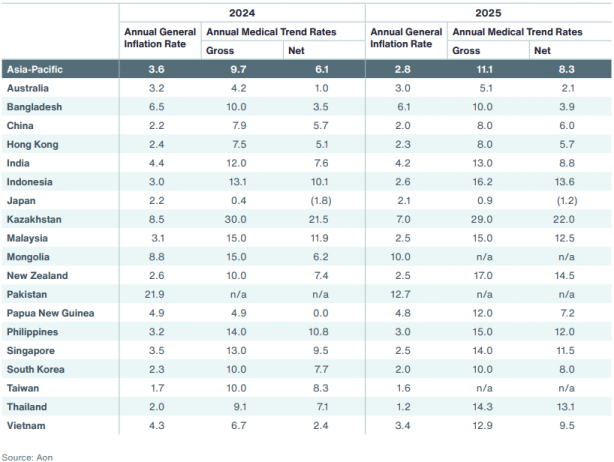

Average Medical Trend Rates in the Asia-Pacific (APAC) Region

This trend underscores that some inflation is unavoidable, prompting employers to seek alternative solutions before medical coverage becomes unaffordable for their employees.

How are top employers managing rising employee health insurance costs?

According to the Global Medical Trends Report for 2025, leading companies are implementing several strategies to manage increasing employee health insurance costs:

- Wellbeing Initiatives

- Focus on preventative care to reduce the need for expensive treatments later.

- Promote stress reduction to prevent health issues exacerbated by stress.

- Cost Containment Measures

- Introduce higher deductibles and copays to control overuse of healthcare services.

- Offer flexible benefit plans that encourage employees to make cost-effective care decisions.

- Flexible Benefit Plan

- Allow employees to customise their benefits based on individual needs.

- Help employers cap overall costs while encouraging behavioral changes in employees.

- Data Analytics

- Use data to identify key cost drivers and optimise plan designs for better efficiency.

- Alternative Funding Models

- Explore self-funding or captive insurance models to gain more control over costs.

These strategies collectively aim to balance affordability and comprehensive coverage while enhancing employee health and addressing rising premium challenges.

The Global Medical Trends Report for 2025 notes that chronic conditions like cardiovascular diseases, cancer, and hypertension drive medical inflation. However, many of these conditions can be diagnosed earlier and managed more effectively through preventive measures.

In our previous blog, 'Influenza Outbreak Alert: Key Strategies Employers Must Know,' we discussed how preventive care reduces medical claims and costs. Now, let's explore how businesses can effectively implement preventive care programmes to maximise their ROI.

Tailoring Preventive Care Programs

By customising preventive care based on specific criteria, organisations can allocate their budget more efficiently to meet individual employee needs. This approach not only enhances employee satisfaction but also helps attract and retain talent.

Criteria for Customisation:

- Age-Based Programmes: For younger employees in their 20s and 30s, focus on initiatives that encourage physical activity and mental health. In contrast, older employees aged 50 and above benefit from screenings for chronic conditions such as diabetes and heart disease.

- Medical History Consideration: Employees with frequent hospitalisation records may benefit from targeted interventions such as personalised health coaching or disease management programs.

- Marital Status Considerations: Families with children might benefit from family-focused wellness initiatives or parenting support groups. Single employees could be targeted with solo-friendly fitness classes or stress management workshops.

By leveraging flexible benefits plans, businesses can effectively implement tailored preventive care strategies.

Taking Advantages of Flexible Benefits Plans

Flexible benefits plans allow businesses to:

- Customise Benefits Categories: Tailor benefits according to specific workforce needs.

- Cap Overall Benefits Costs: Control budget by setting limits on total benefits expenditure.

- Set Up Tiering Based on Employee Position and Role: Allocate different levels of benefits based on job responsibilities or seniority.

While some employers may see flexible benefits as an additional cost, they are crucial for reducing rising employee health insurance premiums. To overcome resistance, organisations can educate employees on the benefits of customisation and offer incentives for participation in wellness programmes.

Prioritising flexible benefits is a proactive way to manage employee benefits and reduce rising insurance costs. Tailored plans can boost employee satisfaction and yield significant cost savings. Organisations should take action to address rising health insurance premiums through flexible benefits.

Related articles:

About Mednefits:

Mednefits helps businesses take care of their employees with its automated, affordable, and accessible employee benefits platform. With over 800 clients in Malaysia and Singapore and more than 150,000 users, we simplify the complexities of HR tasks, making it easier to provide personalised and accessible solutions.

Join us for instant cashless access to our extensive network of medical and wellness providers nationwide.