How to communicate employee benefits in 5 steps

December 28, 2022

Inpatient vs Outpatient – Which Should Employers Use

December 28, 20223 common mistakes that cost your employee benefits ROI

Employee Benefits

3 common mistakes that cost your employee benefits ROI

December 28, 2022

Most people think of employee benefits as a perk, something nice that companies offer their workers in addition to a regular salary. But employee benefits are actually much more than that. They can be a powerful tool for businesses to attract and retain top talent, and they can also have a significant impact on the bottom line.

In order to get the most out of employee benefits and save money, it is important to understand how to maximise your employee benefits so you can get the most ROI out of every dollar.

The first step to maximise your employee benefits is making sure your people are using the benefits in the first place. If your employees can't benefit from the benefits (pun intended), you might as well throw dollars into the river.

That's why in this article, we'll cover the top 3 common mistakes employers make and how to avoid them.

1: Employee benefits are driven from top-down

When the leadership enforces employee benefits without their employee's consent, the employees will likely ignore the benefits.

This is especially painful to the pocket when the company spends hundreds of thousands to roll out a new benefit only to find out it's not important or appreciated by their employees.

Employee benefits programs should be a two-way street instead of one.

By understanding what your employees' needs are, you can craft effective employee benefits that will improve your employees' lives as a whole. In turn, you will likely see increased productivity, employee engagement, and revenue.

What should employers do instead?

Before implementing or enhancing your employee benefits, consider asking your employees for their thoughts about existing benefits and find out their immediate and long-term needs.

If your company is small, a simple way to start is to hold one-on-one meetings with your employees and ask them. Questions like,

- Do you know who you can to talk to if you don’t understand your employee benefits?

- Do the current employee benefits meet your and your family’s needs?

- Do you understand clearly the benefits and policies that affect you?

- Do you think the wellness benefits have improved your physical and mental health?

- What other benefits would you prefer?

- Would you like to know more about the benefits available to you?

If your company is medium to big-sized, conduct a survey to get a pulse of your employees' condition and needs. Doing a company-wide survey might feel intimidating if you haven't done it before, but don't worry. Here's a simple guide for you to find out the most important benefits perceived by your employees.

More companies are emerging to offer a holistic employee benefits package that speaks to their employees' needs. The package can span from family healthcare, childcare, mental, to financial, and more.

The reason why employee benefits are shifting to a more holistic cover is that employers start to understand that personal problems will flow into their employees' work-life.

As a result, the employees can't focus, underperform, and affect the company's bottom line.

When the employee’s personal life becomes worry-free, they can focus 100% at work.

In short: Ask your employees about their immediate and long-term needs, in and out of work, before changing your employee benefits package.

2. Employee benefits are primarily a 'one-size-fits-all' approach

Here's the reality right now:

Employers rolled out 10 benefits, communicated them across the board, and after a few months, they analysed the benefits usage. It turns out that less than half of the benefits are used.

This is the 'one-size-fits-all' approach where each employee, old or young, male or female, on-site or remote, is exposed to the same benefits, whether it's relevant to them or not.

It's like you're throwing 10 darts blindly toward the target and hope one or two will land. Doing so not only wastes time and effort, but the money invested also goes down the drain.

What should employers do instead?

What if you could identify each employee's benefits usage and preferences, personalise the package according to their needs, and pay for only what they use?

Emerging HR technologies have enabled such a level of personalisation and flexibility. Cool right?

With the power of data and technology, one look on the screen can instantly show you patterns of your employees' behaviours (in terms of benefits usage) and help you deliver personalised benefits to specific employees in a few clicks.

The best part is that at the end of the month, you're paying for only what was claimed, not covered.

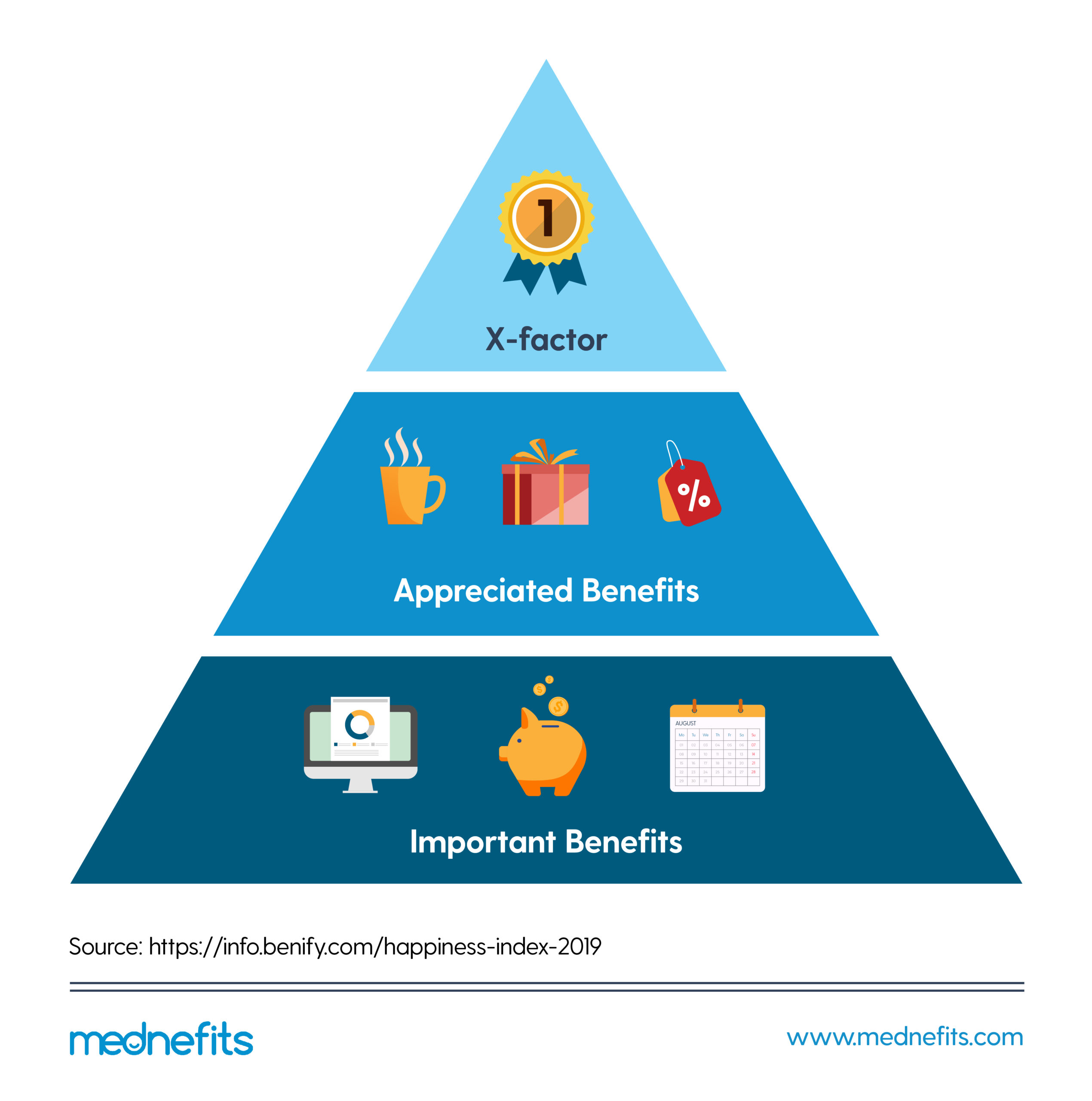

Besides using HR tech, another way to deliver personalised benefits is by using the Benefits Pyramid model.

Each benefit in your company is categorised as either important, appreciated, or unique.

A simple way to understand the differences are:

- Important benefits: Must-haves

- Appreciated benefits: Nice-to-haves

- X-Factor: The benefit that makes you stand out

While each employee may prioritise some benefits over the other, it's easier to manage benefits personalisation when you group your employees according to their generation, job role, gender, family status, or health condition.

A common categorisation is by generation.

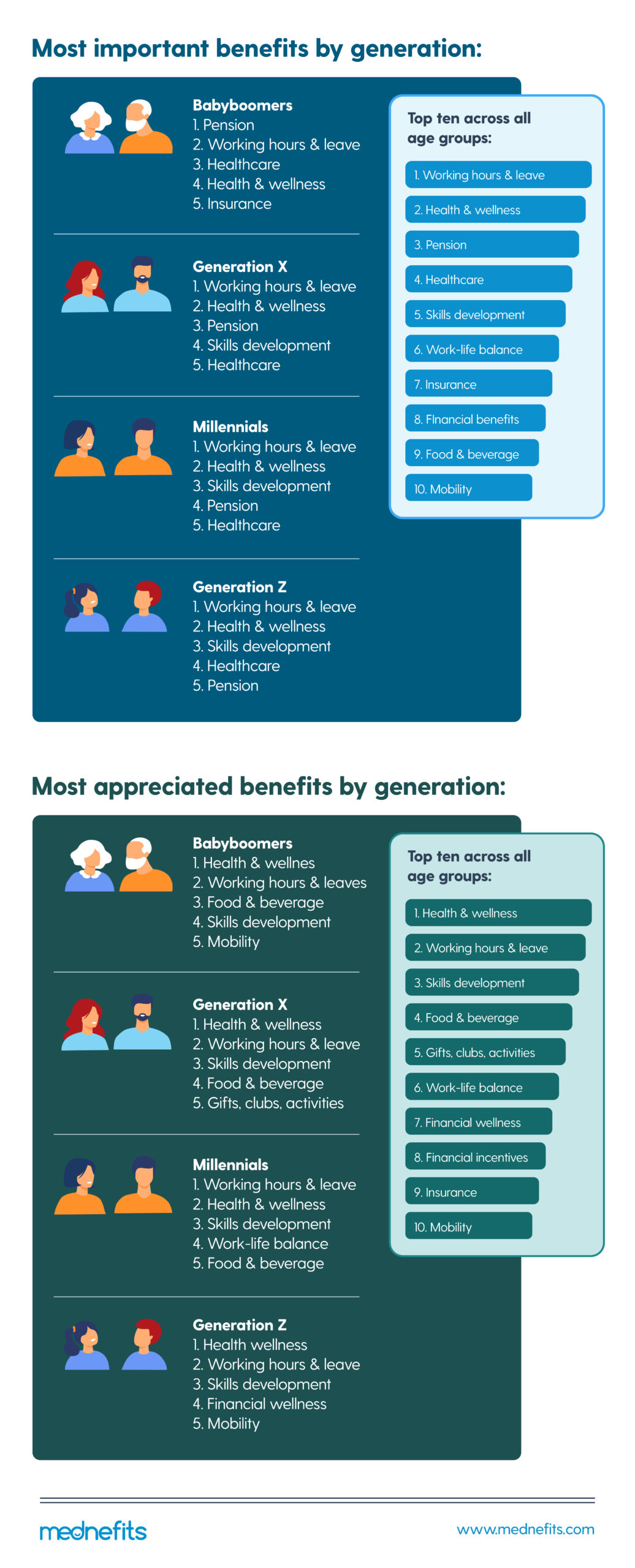

According to the Happiness Index 2019, each generation perceives different benefits as the most important and most appreciated to them.

Most important and most appreciated benefits by generation:

With this data, you’ll have a great starting point personalising your employee benefits in the long run based on their actual needs, not what you think they need.

In short: Using HR technology and knowing which benefit is the most important and most appreciated can help you further personalise the benefits according to their diverse needs.

3. Employees don’t know the benefits available to them

Another reason why some employee benefits fall way behind is due to the way they are communicated.

If you think communicating employee benefits once is good enough, the statistics below will make you think again.

A survey by Maestro Health showed that 35% of employees either only somewhat understand, don't understand, or know nothing about their healthcare coverage.

Nearly 7 in 10 employees want to hear from business leaders about their benefits after they've already signed up for them.

The truth is that your employees are overwhelmed with information. They receive hundreds of emails and thousands of messages.

Chances are, your benefits communications are buried among them.

What should employers do instead?

So, how do you ensure your employee benefits are communicated, understood, and used?

The rule of thumb is to keep employee benefits communications relevant and regular.

Ask yourself these questions before you send the communications:

- Is this employee benefit important to my employee?

- Is it easy for them to understand and access the employee benefits?

- Are there any employee benefits they’re missing out on?

- Is this update important to everyone, or just to a group of people?

- What kind of questions might they have about the new update?

If you want to get your benefits communications announcement read and understood, here's a suggestion from us.

Draft 4 different emails, each email for different generations. Each email highlights different benefits at the top, starting from the most important and most appreciated benefits of the specific generation. Then, communicate the rest of the benefits. Finally, direct your employees where to go if they need more information.

Next, you need to make the communication regular so that your employees will know which benefit to use when the time is right.

All in all, keep these 3 questions in mind when strategising your employee benefits plan:

Have we obtained a pulse of our employees about what they need and what they think about employee benefits?

Are we using the ‘take it or leave it’ approach or offering personalised benefits to each employee?

Are we keeping employee benefits communications relevant and regular?

Perhaps, the most important question of all: Are we creating a great employee experience for all of our workers?

Related Articles

- The ultimate guide to reducing employee benefits costs

- Inpatient vs Outpatient - Which Should Employers Use

- The ultimate guide to employee benefits (Malaysia | Singapore)

About Mednefits:

Mednefits helps businesses take care of their employees with its automated, affordable, and accessible employee benefits platform.

Request to join Mednefits for free to help process and track claims in real-time, while controlling costs.