Employee Benefits Trends Report download is ready (July 2022) – MY

July 17, 2022

How to attract and retain employees – the complete guide

October 3, 20225 steps to implement flexi benefits — what it is and why it matters

Employee Benefits

5 steps to implement flexi benefits — what it is and why it matters

July 25, 2022

What are flexi benefits?

Flexible benefits allow employees to choose from a wider range of benefits than what is typically available through a package. Employers ultimately determine the amount of choice they want to give employees around the kinds and levels of benefits accessible to them, although the term "flexible" stems from employees having a variety of choices.

Everyone is unique, including their needs and lifestyles. As a result, some benefits will be wonderful for some of your employees but pointless for others. That's why having a degree of choice is so important.

The big challenge now for employers is to make their employee benefits plan as flexible as possible to help meet the new needs of employees and create a fully personalised employee benefits experience.

But with the advancement of technology, it is now possible to implement flexible benefits with minimum administrative burden.

How does a flexi benefits plan work?

There are two ways to make flexi benefits plan work for you:

1) Set a pool of benefits for your employees to choose from.

Each benefit has a spending limit for that year. Say, you offer health screening, gym membership, and transportation as flexi benefits. And each of them has a spending limit per year or per month.

2) Set a pool of funds for some or all of your benefits.

There is no spending limit per benefit, but there is a final sum limit. For example, you group all the wellness benefits under one roof and cap them at $4,000 a year. Your employees will choose which wellness benefits to use. It's up to them to decide how much to spend as long as they're below the cap.

The biggest difference between these two methods above is how you limit the funds. Either you set limits per benefit or use a final sum. Both ways still give your employees plenty of control and make sure your budget stays intact.

Why are companies switching to flexi benefits?

Reason 1: Attract and retain the cream of the crop

Gone are the days when it's the employers who make hiring decisions. With the rise of social media and online job searching, it's now the candidates who have the power to decide.

In order to attract top talent, companies need to offer attractive employee benefits that their potential employees want. That’s why 68% of companies are offering flexi benefits.

Reason 2: Better financial control

Flex plans allow an employer to set a monthly spending limit, which results in the company knowing exactly how much the annual spend ison its plan. This aids with budgeting at the end of the year and becomes a predictable cost for businesses. Furthermore, these benefits are tax deductible.

Reason 3: Increased employee productivity

Productive employees improve company efficiency. The World Economic Forum conducted a meta-analysis of 339 different Gallup studies. The analysis confirmed that employee productivity and performance is directly correlated to their well-being.

So, how do you improve employee well-being (which subsequently improves productivity and performance)? According to research, one way is to provide flexible benefits.

What are the pros and cons of using flexi benefits?

Pros

- Increased employee satisfaction and motivation

- Better financial control

- The ability to attract and retain top talent

Cons

- Transition from traditional to flexible benefits plan is challenging

- Set-up requires costs and learning new things

- Need to convince management

What are the examples of companies offering flexi benefits?

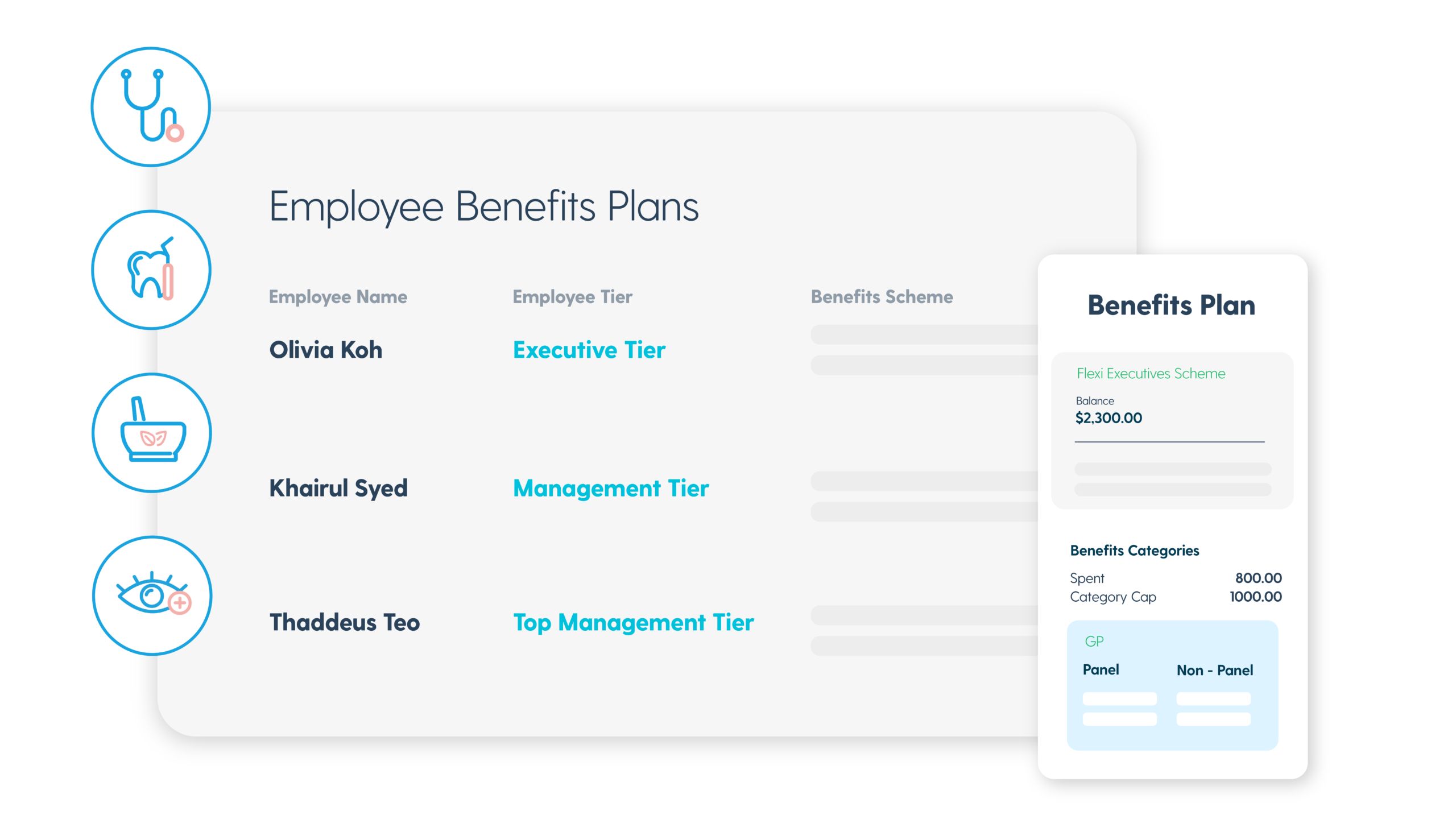

Example 1: Mednefits

Employees can utilise the flexi benefits value allotted to them in their Mednefits account for a wide range of benefits choices including GP, dental, TCM, specialists, optical, and wellness (chiropractic, physiotherapy, fitness, massage, holistic wellness, pilates, etc). Utilised amounts will be deducted directly from their app, eliminating the need for claim submissions.

Example 2: Accenture

Every employee is entitled to a fixed spending value in their flexible benefits account (depending on their employment rank). Within that budget, the employees can claim health, wellness and lifestyle benefits such as gym memberships, GP consultations, optical, dental, sports equipment, flight tickets, and so on.

On top of that, Accenture also allocates a specific amount for telecommunication costs (mobile phone, mobile data or internet). The company also allows its employees to cash out or bring forward unspent leaves.

Which flexi benefits attract and retain talents the most?

Most companies implement flexi benefits for one reason: to attract and retain the best talents.

But are all benefits equal?

Not at all.

Some benefits seem to be much more popular than others across the board, while some seem to be more popular among certain generations.

That's why it's critical to find out the types of benefits that YOUR employees want and need. We have an ultimate guide to help you through the process.

You'll also need market data to help you make accurate decisions. Luckily, we have done some research for you. Read the articles below to find out which benefits attract and retain talents.

5 steps to implement flexi benefits in your company

Step 1: Define your company objective

It's critical to define your company goals and objectives first. You must be clear on what you want to achieve and how flex benefits can assist you in attaining these aims. These aims could be to enhance staff satisfaction, attract new talent, or anything else. Furthermore, consider how a flex benefit program may influence your tax liability and other financial obligations.

Step 2: Research the types of flex benefits

There are many different types of flex benefits out there, so it's important to find the ones that fit your company best. You can do this by surveying your employees, researching the types of benefits that are most popular, or looking at what your competitors are offering.

Step 3: Decide on a budget

Flexible benefits programs can be expensive, so it's crucial to set a budget before deciding on which benefits to offer. Consider how much you're willing to spend on the program and how this will impact your bottom line.

Step 4: Implement the plan

Now that you've decided on a budget and the types of benefits you want to offer, it's time to implement the plan. This involves choosing a provider like Mednefits, setting up the program, and training your employees on how to use it. Find out the process to implement flexible benefits with Mednefits here.

Step 5: Evaluate the plan

It's important to regularly evaluate your flex benefits program to ensure that it's achieving its objectives. This involves conducting employee surveys, evaluating benefits usage data, reviewing your finances, and assessing the overall impact on your business.

How does Mednefits implement flexible benefits with minimum administrative burden?

This is how Mednefits saves you 100+ hours of work annually on administrative work while providing full flexibility on benefits:

1. Create a custom benefits plan for your company

Just give us a list of benefits you want to offer to your employees and a spending cap for each or a spending pool for all or some of the benefits. If you’re not sure what benefits would be attractive to your employees, our Benefits Specialists can share their views on the current popular benefits in the market.

2. Access everything you need from the Mednefits portal and app

Once we’ve implemented the new flexible benefits plan, you’ll be able to see the results on Mednefits’ portal and app.

3. Make data-driven business decisions based on real-time benefits usage

How would you know which benefit to remove or enhance if you don’t have the data? That’s why companies use Mednefits. It monitors your employees’ benefits usage at all times. The system then turns the data into business insights that help you make key business decisions.

About Mednefits:

Mednefits helps businesses take care of their employees with its automated, affordable, and accessible employee benefits platform.

Request to join Mednefits for free to help process and track claims in real-time, while controlling costs.