3 common mistakes that cost your employee benefits ROI

December 28, 2022

How to Engage Remote Employees – 5 Strategies Backed by Science

December 28, 2022Inpatient vs Outpatient – Which Should Employers Use

Employee Benefits

Inpatient vs Outpatient - Which Should Employers Use

December 28, 2022

What is the difference between inpatient and outpatient services?

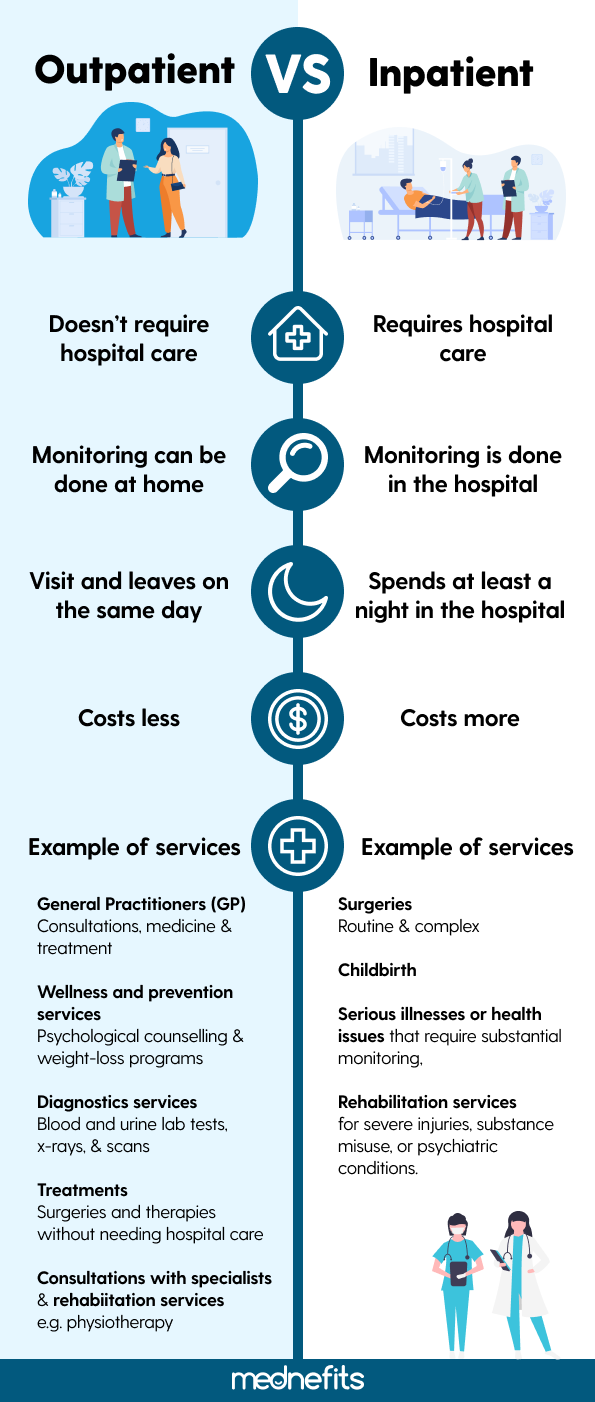

Inpatient and outpatient services are both types of medical care. Inpatient care is when a patient stays in a hospital or other type of facility overnight, while outpatient care is when a patient is seen by a doctor and then goes home the same day.

Inpatient care is usually more expensive than outpatient care because patients need to stay overnight in a hospital or facility and have around-the-clock care. Outpatient care is less expensive because patients do not need to stay in a facility overnight.

Inpatient care is usually covered by health insurance, but outpatient care may not be covered depending on the insurance plan. Some insurance plans only cover inpatient care, while others may cover both inpatient and outpatient care.

If a patient needs to be seen by a doctor for an illness or injury, they will most likely be seen in an outpatient setting. However, if a patient needs major surgery or other type of treatment that requires them to stay in a hospital, they will most likely be seen in an inpatient setting.

How do employers decide which type of service to use?

When it comes to inpatient vs outpatient care, employers have a lot to consider. Medical treatment is just one aspect of patient care, and inpatient care may be necessary for more serious or complex cases. However, outpatient care can often be just as effective and is often more convenient for patients.

In the end, employers will need to weigh all of the factors involved in order to make the best decision for their employees. Cost, medical needs, and patient preferences will all play a role in the decision-making process. By taking the time to consider all of these factors, employers can make sure that they are providing the best possible care for their employees.

If your company is small to medium-sized and most of your workforce are younger people, usually outpatient services alone are enough to meet your employees' medical needs. But if you have a larger workforce with more complex medical needs, then inpatient services may be the best option. It's important to speak with your insurance company or benefits experts to help you assess your needs and make the right decision for your business.

What are the pros and cons of having inpatient coverage?

Pros

- Attracts older millennials, Gen Xers, and Boomers

- Cover the costs of minor surgeries that may require an overnight stay

- Provide peace of mind for employees when *touch wood* something happens

Cons

- Usually more expensive than outpatient coverage

- May not be as necessary for employees with less complex medical needs

- Longer procedures for paperwork and submission of claims

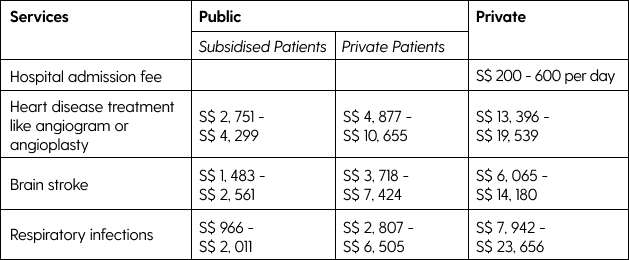

Inpatient costs in Singapore and Malaysia

Singapore

In Singapore, outpatient care is provided in the same tiers as Malaysia: public and private.

Plus another tier for patients in public hospitals only, namely private and subsidised patients. As the name implies, subsidised patients incur lower medical costs compared to private patients.

What are the pros and cons of having outpatient coverage?

Pros

- Cheaper rates than inpatient, thus saving medical costs

- Reduce financial burden on employees when they're not feeling well

- Submission of paperwork and claims are minimal

- May appeal to Gen Zs and younger millennials

Cons

- Older millennials, Gen Xers and Boomers may not feel comfortable having just outpatient coverage

- Most insurance companies don't provide outpatient coverage only. You have to sign up for their inpatient services in order to get outpatient coverage.

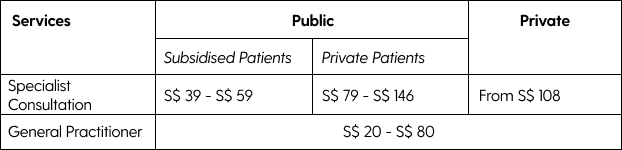

Outpatient costs in Singapore and Malaysia

Singapore

In Singapore, outpatient care is provided in the same tiers as Malaysia: public and private. Plus another tier for patients in public hospitals only, namely private and subsidised patients. As the name implies, subsidised patients incur lower medical costs compared to private patients.

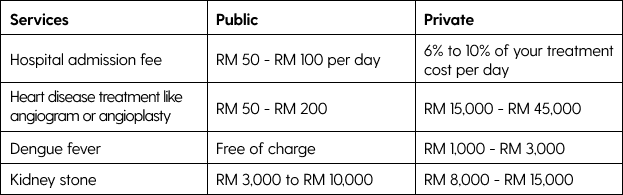

Malaysia

In Malaysia, outpatient care is provided in two tiers: public and private.

In public hospitals, the outpatient and inpatient care costs could range from RM 1 to RM 5 per visit.

In private settings, the cost of a visit to general practitioners is between RM 30 and RM 125, and specialist consultations could cost from RM 80 to RM 235.

How to save medical costs?

Most companies are torn apart between costs and medical coverage. They want to provide more medical coverage to attract and retain employees, but the rising medical costs is an issue that can't be overlooked.

For bigger companies, they have the budget to cover both inpatient and outpatient services for hundreds of their employees. But what about the smaller ones? How are they supposed to provide a broad range of medical coverage with their budget?

That's why most smaller companies opt for outpatient coverage only. It's much cheaper than inpatient, but still able to provide enough medical support to their workforce.

However, most insurance companies require employers to sign up for inpatient services in order to receive outpatient coverage. This requirement has left many smaller companies at a bind.

On a mission to help all companies provide better medical benefits to their employees, Mednefits has an alternative for smaller companies. They can opt in just for outpatient coverage and still be able to get direct access to hundreds of medical and wellness providers in Singapore and Malaysia.

Click here to see how else Mednefits can help you save medical costs.

Related articles:

About Mednefits:

Mednefits helps businesses take care of their employees with its automated, affordable, and accessible employee benefits platform.

Request to join Mednefits for free to help process and track claims in real-time, while controlling costs.