Automating & Optimising for Better Administration of Healthcare Benefits

April 22, 2021

Create an engaging employee handbook – with this free template!

June 28, 2021MediShield Life: Your Puzzling Questions Answered

General

MediShield Life: Your Puzzling Questions Answered

October 17, 2022

What's the first thing that comes to your mind when you look at the hospitalisation bill?

You would probably be concerned about the hefty fees that could leave your bank account drained.

If you hold Singapore citizenship or a Permanent Resident, you can take a sigh of relief because the Government has got you covered with MediShield Life.

MediShield Life can be life-saving when you know how to use it best.

In this article, we have collected the most asked questions about MediShield Life and compiled the answers from trusted experts and the Government.

What is MediShield Life?

MediShield Life is a basic health insurance plan that helps you pay for large hospital bills and selected costly outpatient treatments.

When you go to a public hospital (B2 or C ward), you can claim from MediShield Life.

If you stay at a private hospital or B1 or A wards in a public one, you are also covered by MediShield Life but not as much. You might need to use your Medisave and/or cash to pay more of the bill.

What is MediShield Life Premium?

Premium is an amount paid monthly or annually to the insurer by the insured for covering his/her risks. It's like paying monthly protection fees.

MediShield Life premiums are the amount of money pooled to support the payouts and benefits under MediShield Life.

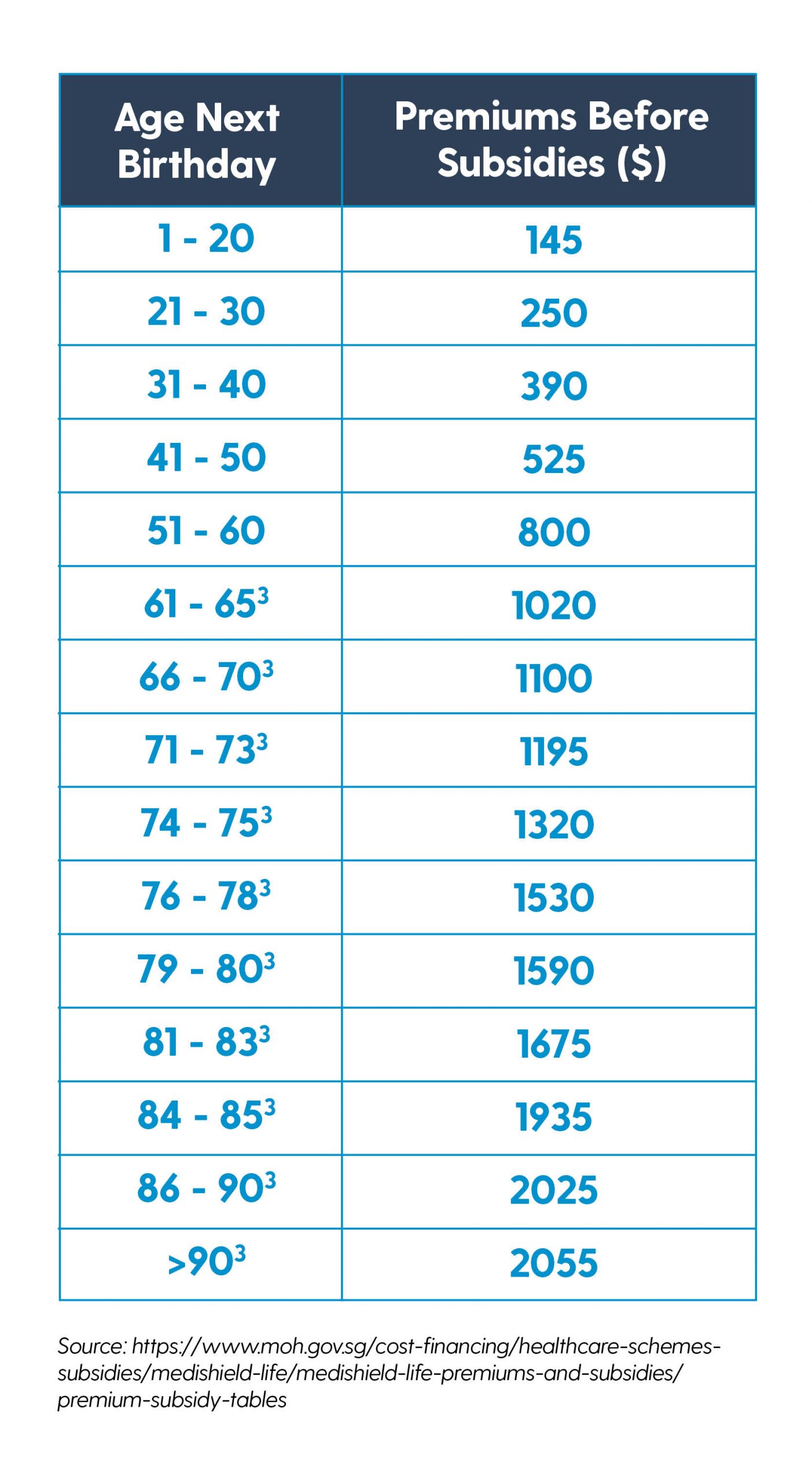

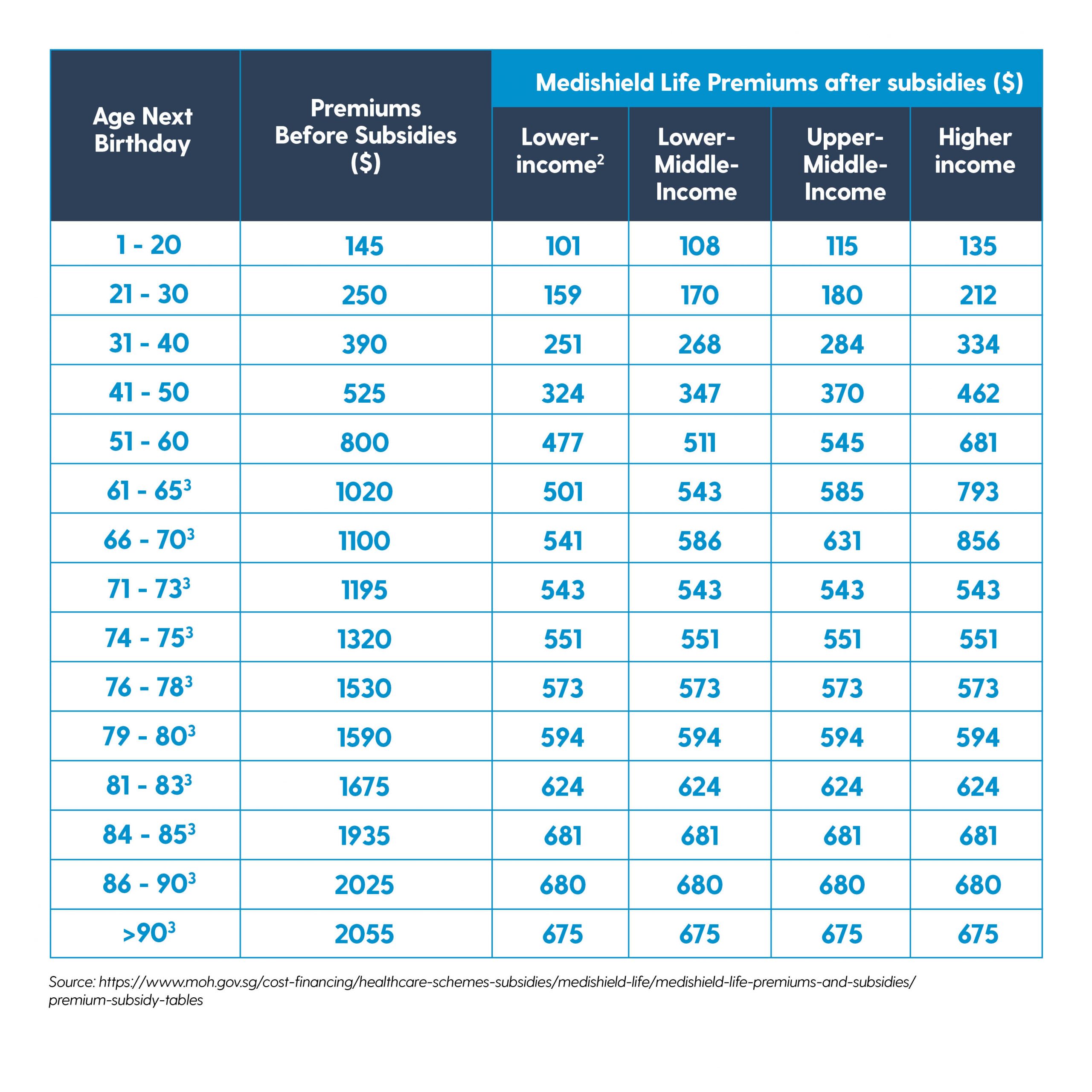

The table below shows the amount of premiums based on your age group:

Should you not be able to pay MediShield Life premiums, the Government provides subsidies to keep premiums affordable.

How do I pay my MediShield Life premium, when do I need to pay, and how long will it last?

If you noticed a part of your salary goes into your MediSave Account, that's how you've been paying for your MediShield Life premium. Each year, a fixed amount of your MediSave Account will be used to pay for the MediShield Life premium.

There's no need to manually pay unless your MediSave Account has insufficient money to cover the annual premium.

What if you forgot to pay your MediShield Life premium? Well, you could face penalties and premium recovery measures. Learn more about them here.

MediShield Life lasts for as long as you live. Unlike other insurance plans that expire when you reach 70 or 80 years old, MediShield stays with you for Life.

Is MediShield Life compulsory?

Yes, it is compulsory for all who are eligible. You will remain insured and receive protection for large hospital and outpatient bills for as long as you live.

Who is eligible for MediShield Life?

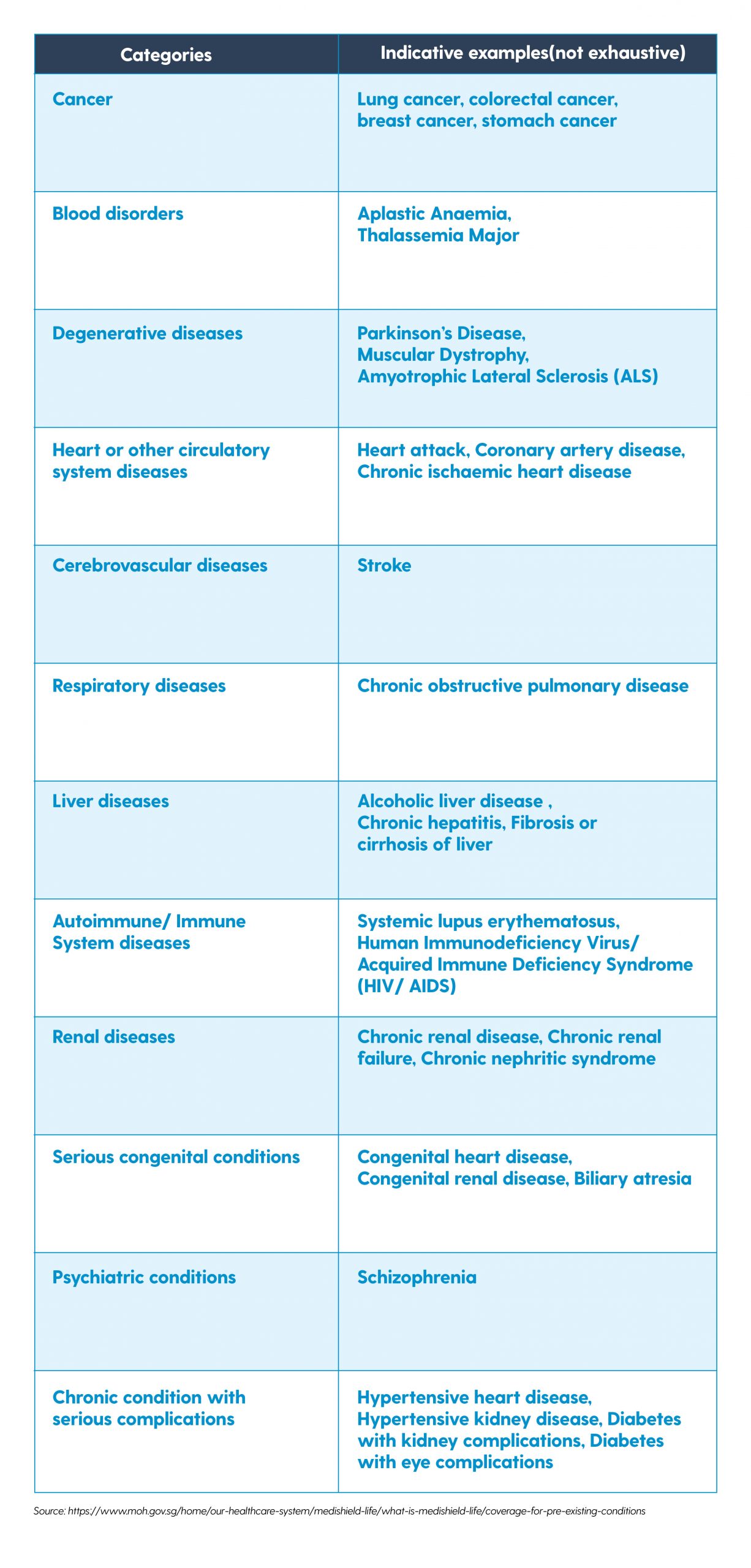

All Singapore Citizens and Permanent Residents, including the very old and those who have pre-existing conditions such as cancer, stroke, heart diseases, and other chronic conditions.

People with pre-existing conditions will need to pay 30% Additional Premiums for the first 10 years. After that, you will pay the same standard premium as anyone else in your age group. You can also use MediSave to pay your MediShield Life premiums, including Additional Premiums.

The table below shows the pre-existing conditions:

What does MediShield Life cover?

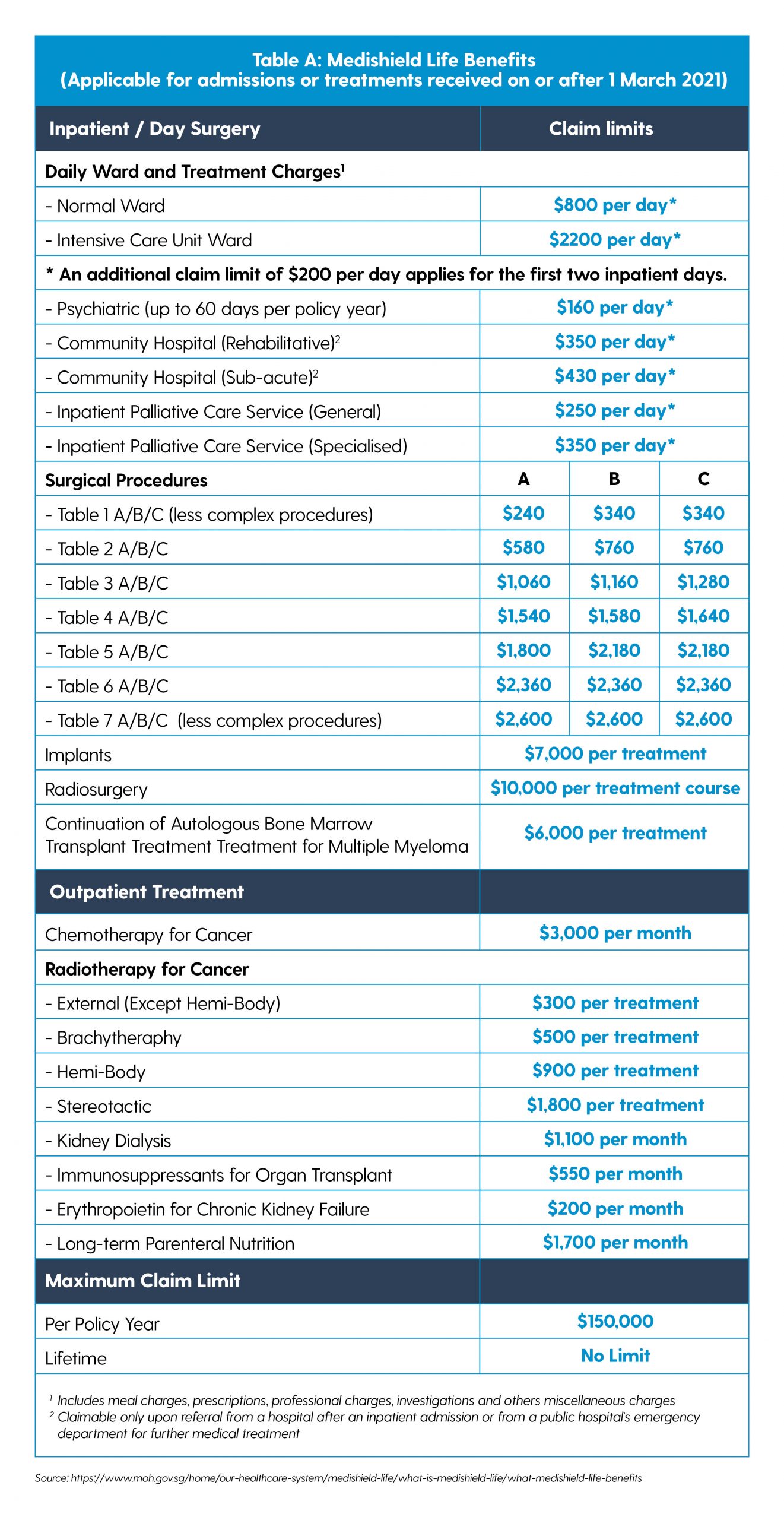

MediShield Life covers anything that falls under subsidised treatment or day surgery at public hospitals (B2 or C wards) and subsidised outpatient treatments for Singapore Citizens.

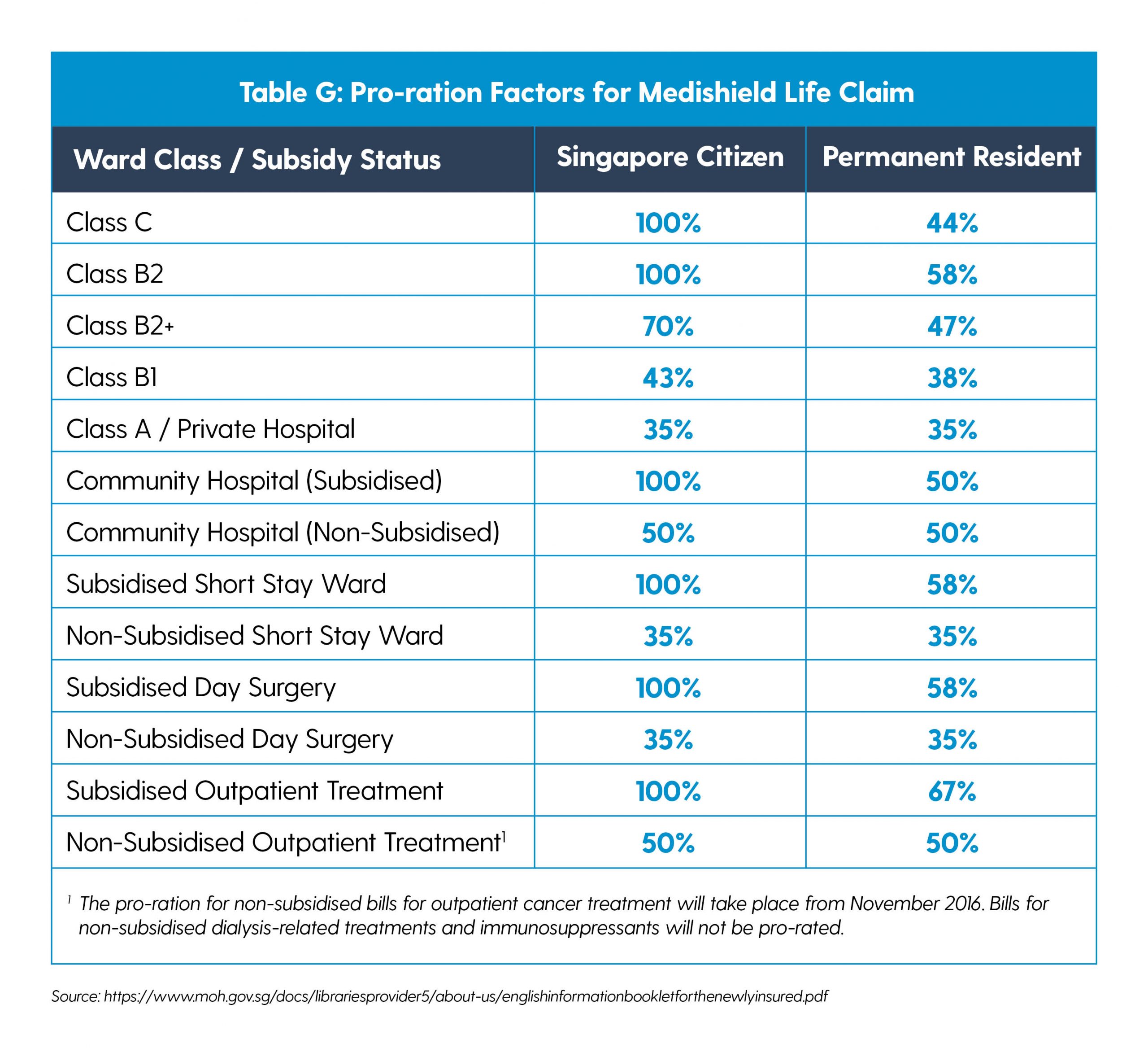

Bills for other wards, private hospitals and non-subsidised treatments and bills for Permanent Residents will be prorated.

But if you want to stay in the type A or B1 ward or a private hospital, you are still covered by MediShield Life. However, you will find that your MediShield Life payout will cover only a tiny proportion of your bill. You would need to draw from MediSave or cash to pay the balance.

The table below shows the type of treatment covered by MediShield Life and the claim limits for each treatment.

Is MediShield Life alone enough?

To decide whether it is enough or not, it might be best to look at how much MediShield Life covers you.

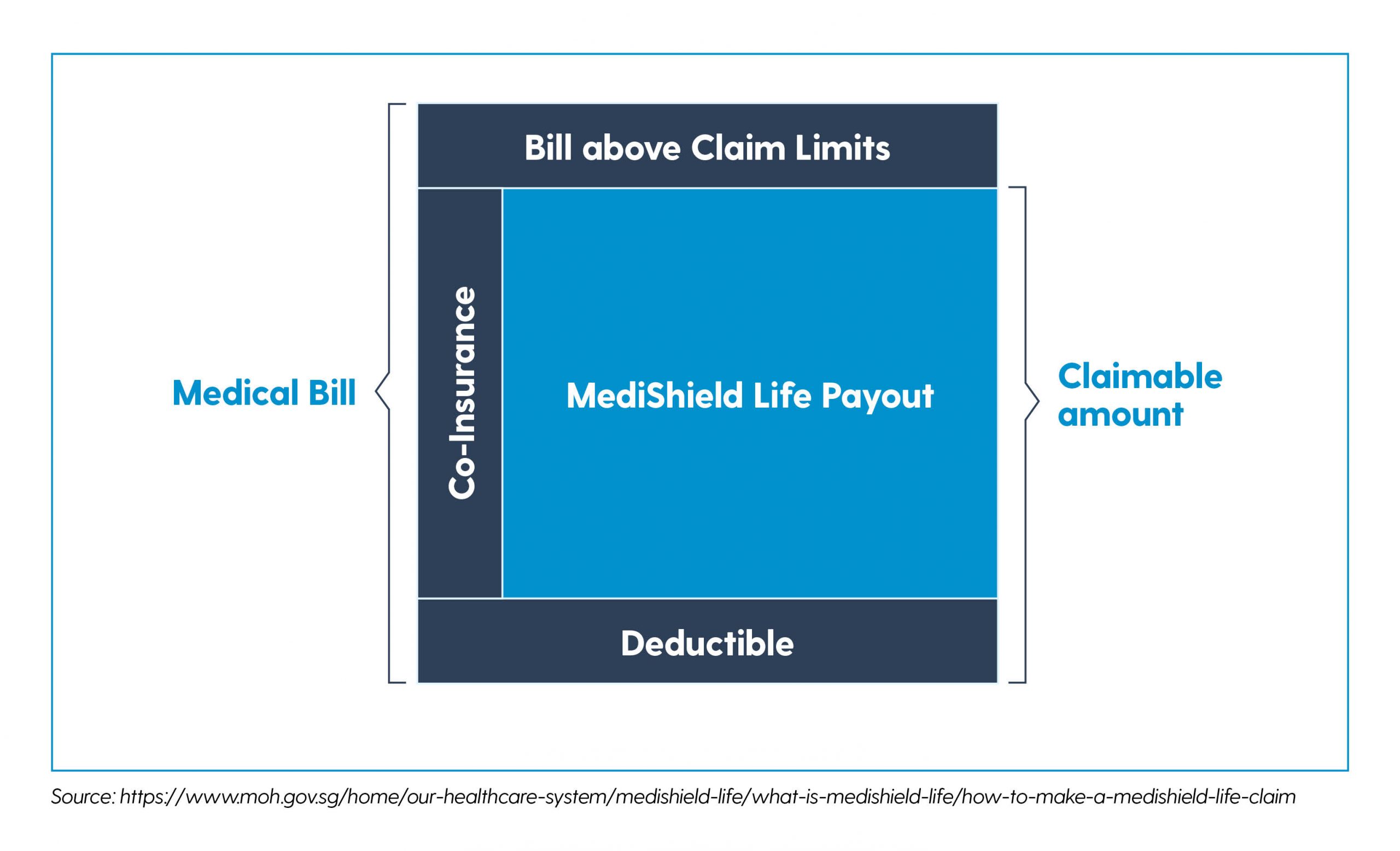

The image above visualises how much you can claim in a single hospital receipt.

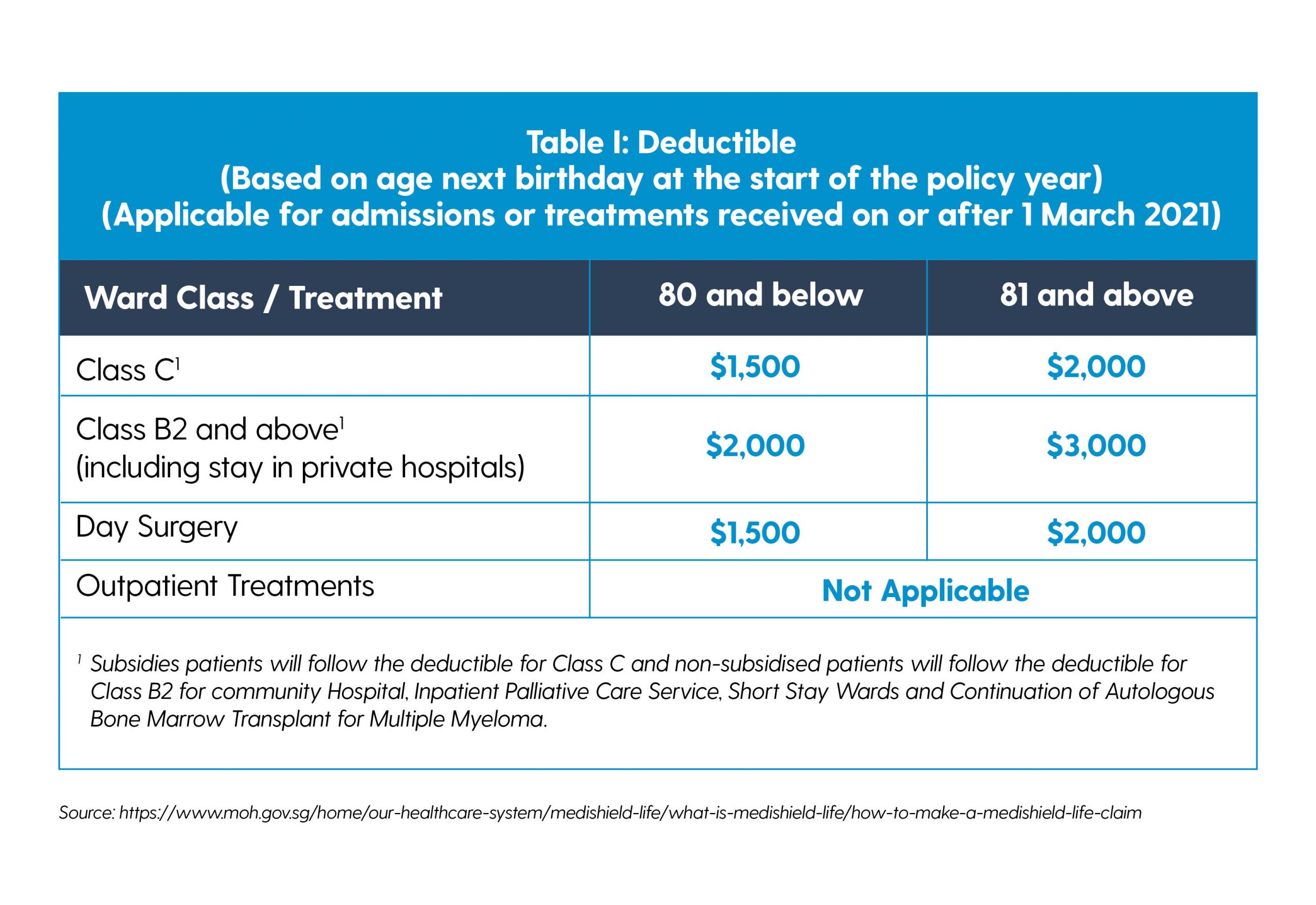

Deductible: A fixed once-a-year payment you need to make before claiming from MediShield Life in any year you are hospitalised.

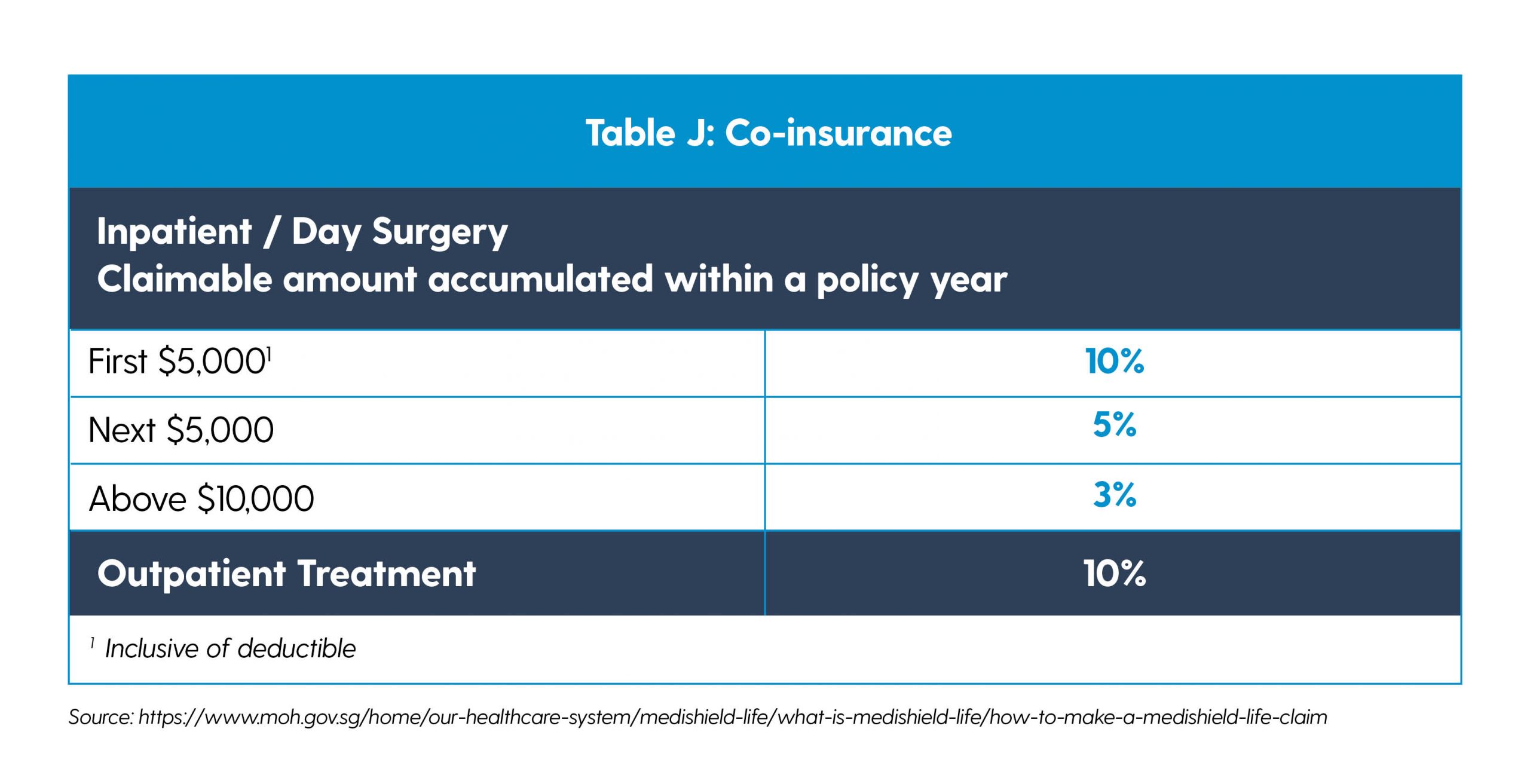

Co-Insurance: a percentage of the claimable amount that you have to pay. The larger the bill, the lower the co-insurance payable. Under MediShield Life, the co-insurance rate starts at 10% and goes lower as the claimable amount increases.

Bill above claim limits: The maximum claim limit per policy year is $150,000 with no lifetime limits. Refer to the MediShield Life benefits above to see the claim limits for each treatment.

Claimable amount: The percentage of a bill that you can claim.

For a Permanent Resident, since the cover limit is less than a Singapore Citizen, you might opt for an Integrated Shield Plan (IP), which combines MediShield Life with a private insurance component.

If you're a Singapore Citizen, you can also opt for an IP with more protection and a claimable amount.

However, do keep in mind that although you do get extra protection and coverage from IP, the costs will rise when the premiums rise, and they cannot be paid fully using MediSave.

The MediShield Life component of your Integrated Shield Plan is fully payable by MediSave.

The additional private insurance component is also payable by MediSave, but only up to the following Additional Withdrawal Limits:

- $300 per year for those at age 40 years and below on their next birthday

- $600 per year for those at age 41 to 70 years on their next birthday

- $900 per year for those at age 71 years and above on their next birthday

Any excess would need to be paid in cash.

Can I still use MediShield if I'm not living in Singapore anymore but am visiting often (e.g., on vacation)?

If you're living overseas, you can suspend your MediShield Life as long as you meet the criteria such as:

- You're a Singapore Citizen

- You have no intention to reside in Singapore based on the following supporting indicators:

- Possess a valid permanent residence permit in their country of residence;

- Resided overseas for at least five years immediately after suspension, except for short visits;

- Have done their full-time National Service or not required to do it;

- Can afford healthcare treatment in their country of residence and declare that they do not need to rely on MediShield Life in Singapore

- Visits to Singapore during the five years should not go more than 140 days. For kids under 5, their overseas residency qualifying period eligibility criteria will be correspondingly reduced, according to their age.

- Applicants should not have claimed MediShield Life five years before the start of the suspension of premium collection.

If you no longer meet the criteria above, or want to claim from MediShield Life during the period, the suspension will stop. And you need to pay the accumulated sum of unpaid premiums plus interest.

Related articles:

About Mednefits:

Mednefits helps businesses take care of their employees with its automated, affordable, and accessible employee benefits platform.

Request to join Mednefits for free to help process and track claims in real-time, while controlling costs.