Influenza outbreak alert: key strategies employers must know

February 12, 2025Tax Exemptions on Medical Benefits: Free Perks for Employers

General

Tax exemptions on medical benefits: free perks employers can offer

March 6, 2025

As HR and finance professionals prepare for the 2025 tax filing season in Malaysia, understanding tax exemptions and relief expenses is crucial. This knowledge enables companies to optimise their tax strategies, ensure compliance with Malaysian laws, and maximise financial efficiency.

Which Benefits Are Tax-Exempt for Employers in Malaysia?

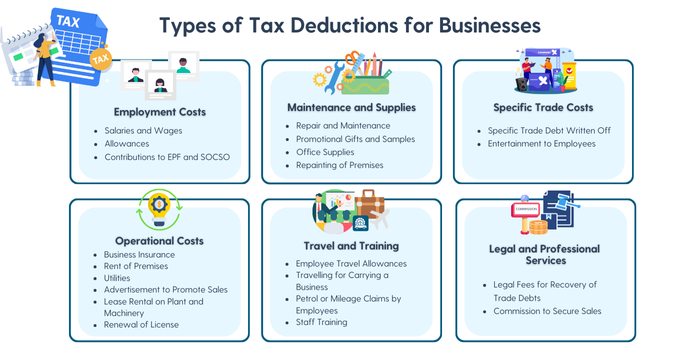

To reduce taxable income effectively, businesses must be aware of the various tax deductions available under Section 33 of the Income Tax Act 1967. These deductions include:

By leveraging these deductions, employers can not only save on taxes but also allocate more resources to employee benefits and business growth.

Tax-Exempt Medical Benefits

In addition to these general tax deductions, understanding tax exemptions for medical benefits is particularly important for employers in Malaysia, as they allow employers to provide healthcare coverage without incurring additional tax liabilities.

- Medical Treatment Expenses

- Medical Insurance Premiums

- Traditional Medicine and Maternity Expenses

- Medical Check-ups and Vaccinations

- Parental Medical Care

Exemption Status: Fully exempted for the employer.

Employers can provide medical benefits, including treatment for serious diseases, without incurring tax liabilities.

Exemption Status: Not directly exempt for employers.

While employers do not receive a direct tax exemption for paying medical insurance premiums, they can deduct these expenses as part of their business costs under general tax deductions.

Exemption Status: Fully exempted.

Expenses related to traditional medicine and maternity care are fully exempt from tax. Similarly, these medical benefits contribute significantly to employee well-being and job satisfaction.

Exemption Status: Fully exempted for the employer.

Employers can cover costs for complete medical check-ups and vaccinations without tax implications

Exemption Status: Fully exempted for the employer.

Employers can provide medical benefits for employees' parents without incurring tax liabilities.

Benefits of Offering Tax-Exempt Medical Benefits

Offering employee healthcare coverage provides tax savings through tax exemptions on medical benefits and boosts employee satisfaction. Flexible healthcare benefits demonstrate a commitment to employee well-being, fostering a positive work environment that encourages loyalty and productivity. This approach reduces turnover rates and improves performance, as employees feel valued and supported.

Understanding which medical benefits are exempt from business tax is crucial for HR and finance professionals in Malaysia. To summarise, by leveraging these tax exemptions, companies can enhance employee medical benefits while optimising their tax strategies.

In conclusion, as tax laws continue to evolve, staying updated on changes—such as those outlined in Budget 2025—is essential for maintaining compliance and maximising tax efficiency.

Reference: Lembaga Hasil Dalam Negeri Malaysia. (n.d.). Notes for Part F of Form EA. Retrieved from https://www.hasil.gov.my/media/forms/upload/form_ba8e92ba-1235-427e-addf-e57a7b027ba9/76adc2ee-ff8b-4e13-a6c2-748d5034078b/notes_for_part_f_of_form_ea.pdf

Related articles:

About Mednefits:

Mednefits helps businesses take care of their employees with its automated, affordable, and accessible employee benefits platform. With over 800 clients in Malaysia and Singapore and more than 150,000 users, we simplify the complexities of HR tasks, making it easier to provide personalised and accessible solutions.

Join us for instant cashless access to our extensive network of medical and wellness providers nationwide.