Careers at Mednefits | Customer Success Admin Assistant

July 27, 2021

Checklist when revamping benefits

August 30, 2021this is the last ultimate guide to employee benefits that you need

Employee Benefits

this is the last ultimate guide to employee benefits that you need

August 26, 2021

The employee benefits package is one of the essential employee retention and recruitment tools you have at your disposal.

But how do you make sure that your company is getting the ROI it deserves?

There are many things to consider when it comes to employee benefits, but it can be hard to keep track of everything with more and more benefits and strategies mushrooming out there.

Plus, if you're new to HR, it's easy to get overwhelmed by everything that needs doing.

The truth is that managing your employees' benefits can feel like a daunting task—but don't worry!

We've put together this guide for HR professionals to enhance your employee benefits management journey with working tactics and strategies.

You'll also learn about some common mistakes employers make (and how not to repeat them), along with tips on making sure your employees actually use their benefits packages!

- What are employee benefits?

- Perks vs Benefits, what's the difference?

- Why employee benefits are important

- 3 reasons why most employers are focusing on employee benefits

- What are the 4 major types of employee benefits?

- What are the top 10 employee benefits In Malaysia and Singapore?

- How much do employee benefits cost?

- 6 common mistakes when managing employee benefits

- Employee benefits management: How to do it effectively

What are employee benefits?

Employee benefits packages are an important part of employee retention and attraction strategies because they allow businesses to compete for top employees.

In fact, retention (72%) and recruiting (58%) were the top reasons for increasing and improving benefits.

If you're not familiar with employee benefits, it's any extra perk or fringe benefits your business offers to its workers. They're usually tied into one or more of the 4 major types of employee benefits.

For example, an employer might offer benefits like flexible working hours for higher productivity and better employee well-being.

Perks vs Benefits, what's the difference?

While there isn't a hard rule, think of benefits and perks this way:

Employee benefits are non-salary compensations to cover an employee's needs.

Perks are extra rewards to "perk" up your employees' lives; in other words, they make their lives more lively and exciting.

Here's an easy-to-understand example.

Health insurance is categorised as an employee benefit instead of a perk because it's deemed as a need, a necessity rather than making your employees happier instantly.

Free fruits and snacks is a perk because it's awesome to have free foods but is it essential? Probably not.

But is it necessary to have both employee benefits and perks in your company?

Absolutely!

Why employee benefits are important

This statistic sums up why benefits should take the spotlight:

- 41% of employees would take a 10% pay cut for a company that cared more about employee wellness (Staples)

- 36% of parents are willing to take a pay cut, while 41% of millennial parents intended to downshift to a less stressful job (Working Families)

- Companies rated highly on compensation and benefits saw 56% lower attrition (LinkedIn)

- 69% of employees say having a wider array of benefits would increase loyalty to their employer (Metlife Employee Benefit Trends Study)

This is a huge contradiction to what most employers think.

They believe that salary is the Number 1 priority in their employee's consideration list.

But the truth is that 'attractive employee benefits' is now standing toe to toe with 'salary' — for 3 good reasons.

3 reasons why most employers are focusing on employee benefits

Reason #1: They want to retain existing employees, especially the really good ones

Surveys upon surveys have shown that more than half of employees across generations would be more loyal to the company if they have a better and wider array of benefits.

- 69% of employees would be more loyal to the company if they have a wider array of benefits (Metlife Employee Benefit Trends Study)

- 70% of US employees are likely to leave for a company that's known for investing in employee learning and development (Harris Poll)

- 78% of employers said they're more likely to stay because of the employer's benefits program (Willis Tower Watson)

Replacing employees costs a lot. You need to spend a significant amount of time and money on recruiting and training talents.

In fact, losing an employee costs 33% of their annual salary. So, if one of your employees, who was paid $36,000 annually, leaves, you have to fork out $11,880 to replace that employee alone!

You don't need a calculator to tell you how important it is to retain employees. And one of the top factors that make them stick with you is attractive and meaningful benefits.

Even better, you don’t need to invest a fortune to retain your top employees.

Reason #2: They want to attract the cream of talents

Do you know why Google and Facebook invest in employee benefits a lot more than an average business?

Because they want the cream of the crop on recruitment. They want the most brilliant talents to work for them.

To do that, they need to offer their employees something extraordinary, something that makes their lives better and more meaningful.

Facebook, for example, allows their employees to bring their pets to the office so they can work happily with their furry friends instead of missing them back home.

The employees themselves have spoken too.

- 60% of employees consider benefits and perks as a major factor when deciding whether to accept a job offer. 80% of them would choose benefits over pay raise (Glassdoor)

- 41% of workers are likely to look for a new job with better benefits. Millennials (57%) and Gen Zers (65%) are even more likely to do so (Unum)

If companies don't revamp their employee benefits, they'll likely get left behind in the talent war.

Reason #3: They want to increase employee engagement

Using benefits to keep employees engaged might be new to you, but it actually makes a whole lot of sense when you understand what drives engagement.

Some tactics to increase employee engagement are enabling volunteer opportunities, prioritising physical and mental health, organising company outings, and more.

The good news is that you can provide all the above through your employee benefits programmes.

What are the 4 major types of employee benefits?

When considering your company's benefits package, we suggest four major categories to think about:

- Work Environment Benefits

- Health & Wellness Benefits

- Financial Security Benefits

- Lifestyle Benefits

Work Environment Benefits

These are the benefits employers offer to support a healthy and engaging working environment. Most of your employee benefits will generally fall under this category.

Here are some examples of work environment benefits:

- Paid leave

- Paid sick leave

- Paid parental leave

- Flexible working hours

- Option to work remotely

- Skills development (personal and professional)

- Subsidised lunches

- Free snacks, beverages, and fruits

- Company events

- Employee clubs and activities

- Paid parking

- "Bring your pet to work" programme

- Casual dress

Health & Wellness Benefits

These are benefits that contribute to the physical and mental well-being of a company's workforce. Some have been around for years, like health insurance, while others, such as mental health and gym membership options, are becoming much more common in today's culture.

Here are some examples to get your creativity flowing:

- Gym membership

- Smoking cessation programme

- Free or subsidised medical check-up

- Mental health therapy

- Masseur in the office

- Dietary counselling

- Health insurance

- Telemedicine

- Psychologist counselling

Free guidebook download: Choosing the right medical benefits plan can be a headache. We have done the research for you and created a free guide that outlines the pros and cons of each employee medical benefits model. Download the guide here.

Financial Security Benefits

Financial security benefits are additional perks offered to employees on top of a salary or bonus. These benefits help to add monetary value to an employee's total compensation package.

A few examples of what financial security benefits might look like in your organisation include:

- Pension plan

- Retirement plans

- Option to exchange salary for pension

- House insurance

- Auto insurance

- Commission

- Performance bonus

- Stock options

- Financial counselling

- Disability insurance

- Life insurance

- Student loan assistance

- Profit sharing option

Lifestyle Benefits

This category of benefits includes all the benefits that go above and beyond to make a person's life easier. These may be different from other benefits, but they are an effective effort to distinguish yourself when hiring talents.

- Home cleaning

- Grocery delivery

- Childcare

- Homework help

- Legal services

- Car leasing

- Public transport allowance

- Congestion taxes

- Bicycles

- Carpooling

- Workplace parking

- Unlimited paid time off

With so many benefits around, how would you know which appeals the most to your current and future talents?

In the section below, you'll learn the top 10 benefits Malaysian and Singaporean employees want.

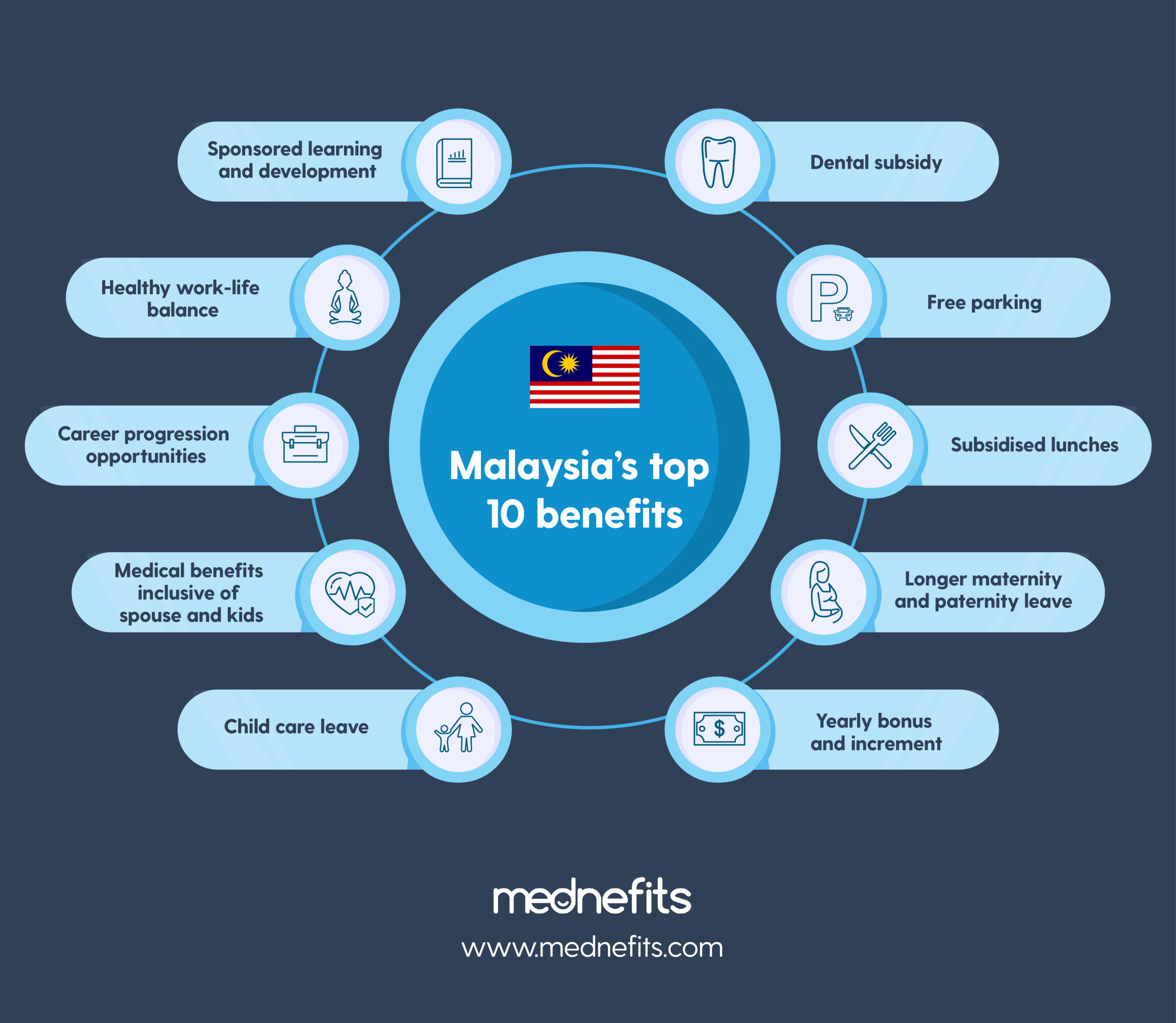

What are the top 10 employee benefits In Malaysia and Singapore?

How much do employee benefits cost?

Somewhere in your mind is probably thinking how much you should spend on these benefits and is there any way to save cost.

Well, having a comprehensive benefits programme will indeed need more budget, but the good news is that you don't have to spend a fortune.

This is the average amount companies based in Singapore spend on employee benefits:

Medical insurance: $361 per case or $5,448 per year per employee

Transport allowance: $150

Annual health screening: $500

Meal allowance: $206

According to the US Bureau of Labour Statistics, the average benefit costs $10.83 per hour worked for private industry workers.

Even better, many low-cost benefits don't cost a dime, such as remote work, child care leave, company shares, and many more.

Did you know medical benefits consume the biggest chunk of your budget? Luckily, there are 3 options to save rising medical insurance costs. Read the article here.

Having a comprehensive benefits package with a lot of options to choose from is great, but if you don't manage them well, your employees won't be able to use the benefits to their fullest, and you most likely can't reap the ROIs.

This brings us to the next point: managing employee benefits using better, smarter ways without taking too many resources.

But before we get to the how-to, it's best to learn from other people's mistakes before revamping your employee benefits management.

6 common mistakes when managing employee benefits

Number 5 is the most common mistake almost every employer makes.

Mistake #1: Not working with a benefits specialist

Benefits plans are complicated in nature. They change, and new laws come out frequently. That is why it's best to work with a benefits specialist when creating a plan for your company.

Benefits specialists are the best type of person to consult with about benefits. They work in tangent with regulators and technology to keep your company compliant while introducing new HR systems that make your life easier.

When you entrust your employer's benefits specialist, they'll help you make more strategic decisions and offer guidance on how to provide a better employee experience within your budget.

Mistake #2: Offering one employee benefits package to everyone in the workforce

If you're offering one benefits package to everyone in the workforce, chances are you're leaving a lot on the table. In fact, offering personalised benefits is one of the major HR megatrends in 2021.

For example, if your employees are mostly younger and healthy, they may not be keen to use sponsored health screenings. Gym memberships and professional development are more appealing to them instead.

On the other hand, employees over 35 with families to support may be willing to pay higher premiums for health insurance in exchange for better hospitalisation coverage.

In short, when building your benefits packages, don't assume you know which one is best for everyone. Get feedback from them and act on it!

A benefits specialist can help you assess what employees need based on their demographics and lifestyle. Different employee needs require different packages to be offered, so keep your options open.

The more tailored your benefits are, the more likely you'll have happy and productive employees.

Mistake #3: Buying based on brand

Three years ago, Insurance X was the go-to for the best benefits on the market. But are they still the best today?

Insurance capabilities change rapidly. By assuming an existing medical insurance has the best coverage and discount available, you may be missing out on a specialised plan that provides better medical benefits at a lower cost or technology that helps employees manage their benefits more effectively.

With that said, switching providers year on year can be equally costly. Without an objective view of the data and marketplace, stagnating with an insurance provider or disrupting the benefits package will be detrimental in the long run.

Mistake #4: Making decisions based on what you think, instead of what the data tells

Does having a larger network of General Practitioners (GP) give employees more choice to choose their doctors?

Is using a self-funded reimbursement plan more costly than insurance plans?

Most employers will answer these questions based on their gut instincts or societal standards instead of what data tells them.

Before making a network decision, have your benefits specialist run a disruption report — a list of the most utilised GPs — to compare the clinics included in the proposed plan with the clinics your employees currently use.

If few of the clinics in the proposed plan are being used by your employers, having a smaller network can help you save costs and meet your employees' medical needs.

Working with a benefits specialist with analytic capabilities enables you to make benefits decisions based on hard facts so that you can make the wisest choice for your company and employees.

Mistake #5: Poorly communicating to employees

If you think having a world-class benefits programme will immediately position you as the most attractive employer, think again.

No matter how much effort you put into the benefits programme, your benefits won’t be used effectively if your employees don't know about it.

This is the most common mistake when it comes to managing benefits.

- 57% of employers believe their workforce is aware of all their benefits and understands them. 28% believe their workforce is aware of all their benefits but doesn’t understand them all. 10% of employers believe their workforce is only aware of some of their benefits (GRiD)

- 42% of adults are unable to identify the terms “deductible”, “co-insurance”, “copay”, and “out-of-pocket maximum” (PolicyGenius)

- About one-third of employees (34%) claim they pay attention to all of the materials they receive about their company benefits (Harris Poll)

Your employees aren't benefits experts. Though they may be the best and brightest in what they do, most employees need help understanding their benefits plans to find the right one for their family's needs.

Make sure you communicate the fundamentals clearly, based on what people really want to know:

- Which panel clinic is the nearest to them?

- How much medical fees can they claim, and how much is left?

- What benefits are available depending on their life stages and needs?

- How much are they contributing for each benefit?

A good benefits specialist can work with you to create an easy-to-follow communications plan and clear any confusions you and your employees might have about the benefits.

Benefits communications with employees should not be an annual event. Instead, make these communications monthly. Focus on specific benefits, such as how to use medical insurance or what health wellness programmes are available.

One way is to set a theme for each month. Say, January is the lifestyle month where you communicate lifestyle-related benefits to employees.

Plus, you can also communicate the value of your benefits plan during these communications. Consider sending out an annual Total Benefits Statement that shows employees the dollars associated with each benefit they have used. This is an excellent way to enhance employee satisfaction and retention because they can see your investment in them.

Mistake #6: Purchasing plans based on price, not coverage details

When it comes to benefits, many employers view them as commodities — giving all companies the same business cards with different price tags. In reality, there is a stark difference between one company's offerings and another's.

Covid-19 has changed the face of employee benefits and insurance, therefore you need to pay even closer attention to these emerging policies given birth by the pandemic.

Choosing a benefits plan requires extensive research. In addition to understanding the outpatient vs inpatient, employers should research other provisions, policies, and stipulations before signing on the dotted line.

Spend some time reviewing the different benefits plans, and work with a benefits specialist to get help understanding all costs. Only then will you be able to make your best choice for your company and employees.

Employee benefits management: How to do it effectively

Employee benefits management can be an overwhelming task, especially when the regulatory aspects are taken into account. But there are ways to manage benefit plans more effectively to save time and cost and avoid the mistakes above.

The following is the 10-step employee benefits management framework to guide your thinking and decision process.

Step #1: Set goals and objectives

Clear goals and objectives set a solid foundation in your employee benefits management.

What is it you're trying to achieve through the use of benefits?

Most companies have one or more of the following objectives:

- To achieve a healthy retention rate

- To attract top talents

- To increase employee productivity

- To increase the overall bottom line

Step #2: Work with an experienced benefits specialist

Provide your existing benefits management plan and the objectives above to a benefits expert with industry experience.

Benefits plan options are numerous and complex. The specialist should be able to help select the best plans that will meet your business goals within budget.

Benefits programmes should also be designed to meet both your and your employees' needs.

Step #3: Choose meaningful metrics to measure

The objective or goal is the final destination, and metrics are along-the-road points that need to be met to reach the final destination.

Some of the metrics we advise employers to monitor closely are:

- How frequent the benefits are used

- What is the annual spending allocation ratio

- Panel vs non-panel spending

- How many benefits are used

- How well employees understand the benefits available

Step #4: Decide the right benefits to offer

It's important to assess what support the employee needs from you. In particular, benefits must be designed to address those issues that are costly for your workers to afford on their own or that they prioritise more than anything else.

Based on what you've learned above, you can roughly guess which benefits would be the most important to your employees, but you won't know for sure until you ask them directly.

One effective way to ask them is to conduct a survey. Follow this 5-step guide to find out the most important benefits specific to your employees.

Step #5: Calculate the budget

Each benefit has an associated cost to it. And the formula is rather simple.

Benefit-cost per year x Number of employees = Annual benefits cost

To show you how it works, one of Mednefits customers has 200 employees, and they offer the following medical benefits:

- General Practitioner (GP) consultations

- Dental visits

- Optical coverage

- Specialist consultations including Traditional Chinese Medicine.

Previously, they spent more than $1,000 on inpatient insurance premiums per employee, with an additional top-up for a GP outpatient rider every year for 200 employees. However, most of the usage was for outpatient services, with no other benefits such as dental.

Now, after using Mednefits as their benefits administration tool, they've extended their benefits beyond inpatient care and outpatient GP to dental, optical, and specialist services without paying for more, for the same number of employees.

The good news is that Mednefits provides comprehensive outpatient benefits packages for any company size – even if you’re as small as a 3-person company that often get rejected from healthcare insurance.

Step #6: Ensure benefits are compliant

Work with your benefits specialist to enhance your benefit offerings and optimise the budget even more. There might be blind spots you have missed that only an experienced specialist can uncover for you.

Also, get your benefits specialist to check your benefits against compliance and law. Malaysia and Singapore have their own employment laws, and it can be difficult to understand on your own. Read more about Malaysia’s employee benefits policies here.

Step #7: Get buy-in from stakeholders

If you’re a HR professional and tasked to revamp the benefits package, chances are, you need to convince your leadership of the reasoning behind the plan.

Your leadership is more concerned about the cost and results instead of detailed processes. So focus on the ROI for every benefit in the proposal. Work with your benefits specialist and get their industry know-how to forecast the ROI based on hard facts instead of gut instincts.

Step #8: Create your benefits communications plan and communicate them out

This is the heart of any benefits success in the organisation. You need to pass your messages across effectively and consistently.

In the past, benefits communications were a lot of email blasts to employees telling them what their health insurance coverages are or reminding them that they're paying for certain benefits and should use them now.

Nowadays, most companies are using their Intranet to spread information and communicate more effectively with employees. Each department has its own area on the Intranet where they can post newsletters, company policies, reminders, and benefits.

You can also leverage HR tech such as benefits apps to show relevant, meaningful benefits at a simple tap.

Another less known method to communicate your benefits effectively is using an employee handbook. An engaging and well-written employee handbook can act as your best communication tool because that's what every new hire needs to read.

Want to enhance your current employee handbook? Download the template here.

Step #9: Appoint employee benefits ambassadors

Don't just stop at email, Intranet or app communications. Your line managers are your best ambassadors in sharing their experiences with their team members.

This is especially important if your benefits are as good as gold.

For example, if you're offering flexible working hours to all employees under certain conditions, encourage them to share how they utilised the benefit with their team members. Their stories will be more engaging than just reading an email and people would trust what their colleagues said about the benefit.

Step #10: Monitor and improvise based on data

Measure the effectiveness of your benefits package by reviewing data.

Start with looking at the usage of the benefits for each benefit across a period.

For example, find out the number of employees who are taking up health insurance coverage. Or you can look at how many employees took child care leave last month and compare it to previous months when no communications about child care leave were done.

If the usage is low, that could mean a few things:

- Very few employees knew about the benefit

- The benefit is useful to a small group of people

- The benefit is no longer relevant to your employees

Use advanced HR tech to automate all these tedious analyses for you and show only actionable steps to improve your employee benefits management.

Final Words

And there you have it, all the information and steps you would need to create and implement a meaningful and relevant benefits programme in your organisation.

If you wish to go deeper into the benefits, we would suggest the following informative articles to you:

- 10 innovative ways to attract and retain gen z talents

- Childcare leave: 8 essential questions employers need to know

- What you need to know about Covid-19 vaccine in Malaysia and Singapore

- MediShield Life: Your Puzzling Questions Answered

- HR’s biggest challenge - Shaping the future of workforce

- How HR can manage remote employees without sacrificing productivity

Found a useful article? Bookmark it so you don’t have to search through the browser history.

About Mednefits:

Mednefits helps businesses take care of their employees with its automated, affordable, and accessible employee benefits platform.

Request to join Mednefits for free to help process and track claims in real-time, while controlling costs.