SATA CommHealth Joins Mednefits

February 16, 2022

Navigating the Great Resignation

April 28, 2022The Ultimate Guide To Primary Care Plan For Your Migrant Workers

Employee Benefits

The Ultimate Guide To Primary Care Plan For Your Migrant Workers

April 22 2022

One good thing about the circuit breaker is that it revealed the gaps in our healthcare system, especially for migrant workers.

Not only were MWs unable to get proper treatment when they needed it most, the employers were burdened with unexpected healthcare costs.

That’s why Singapore’s Ministry of Manpower (MOM) created a new healthcare plan to protect MWs and employers: the Primary Care Plan (PCP).

Most likely, employers like you have a lot of questions around PCP. That’s why we’ve written this article to serve as your one-stop resource whenever you need it.

In this article, you'll learn:

- What is Primary Care Plan (PCP)

- What services are included in PCP

- Is PCP mandatory for you

- How much does it cost (annually and monthly)

- How and where to buy PCP

- Do you need to pay extra for medical visits

- What if your eligible workers already have medical insurance

- How existing medical insurance work with PCP

So, let’s get right into it.

What is Primary Care Plan (PCP)?

Think of Primary Care Plan (PCP) as Medishield Life. Just like how Medishield supports the healthcare costs of Singapore residents, the PCP supports the healthcare costs of migrant workers and employers.

PCP is a financial healthcare scheme made mandatory for employers with migrant workers working in construction, marine shipyard and process (CMP) sectors.

What's included in Primary Care Plan?

Migrant workers with PCP get to enjoy a slew of services such as:

- Medical examination for work pass application or renewal

- Medical consultation, physical and clinical examination, including chest x-ray, blood tests and investigations (where applicable)

- Medical consultations and treatment

- Unlimited acute/chronic consultations at MOM Medical Centres, Telemedicine or Mobile Clinical Teams (including public health activation)

- Standard medications and treatments, in accordance with MOH’s List of Subsidised Drugs

- Basic laboratory tests (including logistics)

- X-ray

- Simple procedures, including basic removal of foreign body, wound dressing, toilet and suturing, removal of sutures and therapeutic injections

- Mental health counselling, as required

- Transportation to and fro between MW’s dormitories and medical centres within the sector

- Including ambulance and special transport services

- Excluding routine specialist appointment

- Medication delivery

- For tele-consultations between 8.00am and 5.59pm, same day medication delivery

- For tele-consultations between

- Annual basic health screening

- Physical examination, including mental health assessment

- Blood pressure, body mass index, height, weight

- Chronic illness such as diabetes and high blood cholesterol (as recommended by doctor)

Is purchasing PCP for MWs mandatory for employers?

If you have MWs holding Work Permit and S Pass who live in dormitories OR work in construction, marine shipyard, and process (CMP) sectors, you’re required to get them PCP.

The deadline to get PCP for all your eligible MWs is until 31 March 2023 — even if their renewal is after 31 March 2023.

You’re NOT required to buy PCP if you have migrant workers holding a Work Permit or S Pass living in a community and working in a non-CMP sector.

How much does PCP cost?

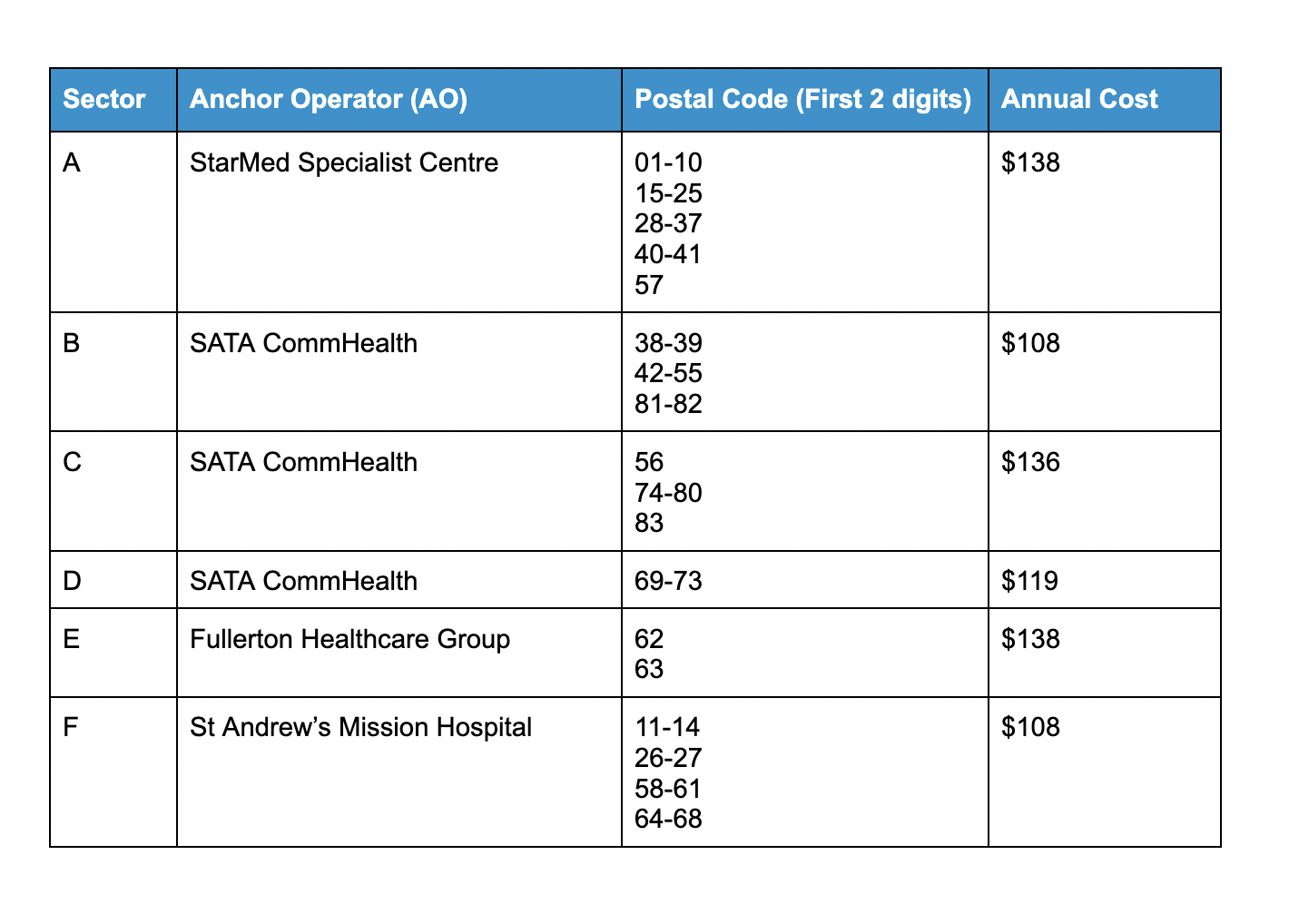

It costs from $108 to $138 a year, depending on the sector your MW lives in. The annual cost is payable in monthly instalments via GIRO only.

So, how do you know what the PCP cost is for your specific MWs?

Well, just look at the first 2 digits of their resident postal code. And contact the AO in charge of your sector to buy PCP (will cover more details in the next section).

Also, the Ministry of Manpower (MOM) has divided areas in Singapore into 6 sectors and appointed 6 Anchor Operators (AO) to manage each sector.

Here’s the breakdown:

Find out about each AO:

- StarMed Specialist Centre (as of this article is written, StarMed don’t have an info page about PCP yet. You’ll need to contact them directly via phone, chat, or email).

- SATA CommHealth

- Fullerton Healthcare Group

- St Andrew's Mission Hospital

Now, this is for you if you want to know more about the nitty gritty part.

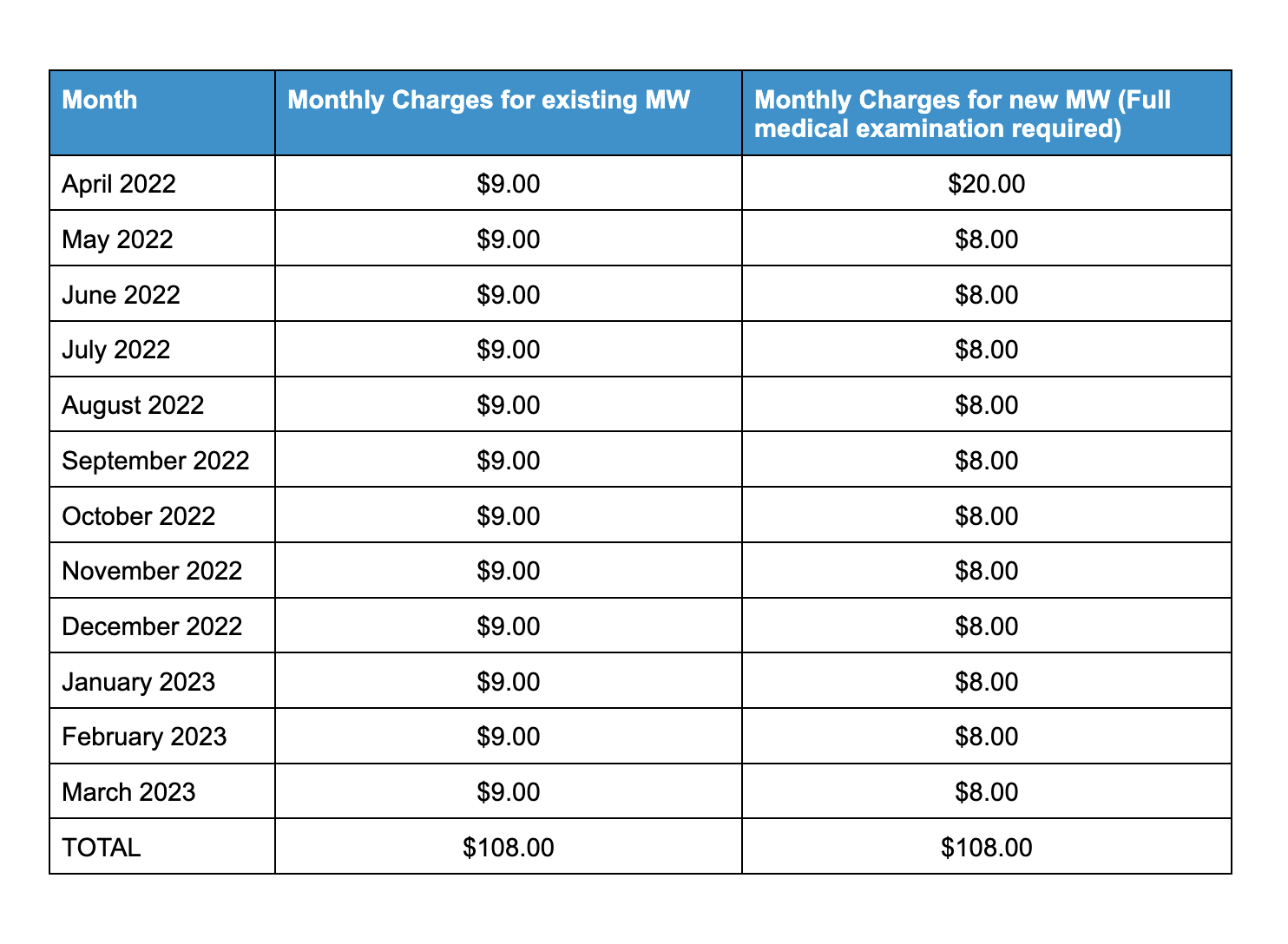

You’ve determined the annual cost you need for your MWs.

The question is, how much will you be billed per month?

Here’s an example if the annual cost is $108.

How and where to buy PCP?

StarMed

Contact them via phone (9655 2101), email ([email protected] or whatsapp.

And they’ll ask for the following information:

- Name

- Designation

- Company Name

- Contact Number

- Location of Dorm/Community Residing

- Postal Code

Send the information and StarMed will guide you through the process.

SATA

Provide the following details to [email protected] for verification:

- Name of company / entities

- The sector your MW lives in

- Number of MWs

Then an Account Manager will guide you through the process.

Additionally, you’ll need 2 documents to onboard:

- Your company ACRA (at least 6 months from the date the records were obtained)

- SATA credit facilities form (given by the account manager)

Fullerton Healthcare Group (FHG)

Go to http://pcp.fullertonhealth.com/ to register your company and MWs. Then, you’ll need to submit a letter of authorization and to download a GIRO Form to complete the registration.

Once the registration application is processed, you may begin to enrol all eligible MWs once the platform is fully rolled out.

St Andrew's Mission Hospital

There are no exact steps provided by St Andrew’s Mission Hospital. For now, employers need to register by contacting them via phone (8126 9758) or email ([email protected]).

Is there extra payment needed?

Yes, there’s a co-payment involved.

For each visit to the medical centre, workers are required to pay $5.00. For telemedicine service, it’ll be $2.00.

What if your MWs already have medical insurance, is PCP still required?

The short answer is Yes.

The long answer is:

If you’ve already purchased inpatient or hospitalisation insurance for your eligible MWs, PCP is still a mandatory requirement. Because it doesn’t cover inpatient care. PCP covers only outpatient primary care.

If your eligible MWs already have outpatient insurance, you’ll also have to buy PCP for them.

MOM suggests reviewing the medical care coverage for your MWs and exploring ways to save costs without paying for redundancy (will cover how to do this in the next section).

How does medical insurance (benefits plan under Mednefits) work with PCP?

You might have realised that some services covered by PCP overlaps with your existing medical insurance (called benefits plan - if you are using Mednefits).

However the areas where PCP lacks can still be covered by your medical insurance (benefits plan).

For instance, PCP covers specific medical services obtained from clinics in your designated sector. As such, visits to other clinics will not be covered.

In this case, companies with a more comprehensive medical benefits plan via Mednefits can still support their MWs healthcare costs. As for companies which have their own medical insurance, you will need to check with your insurer on the coverage.

And, remember there’s a co-pay involved? If you’re using Mednefits, you can claim that $5 or $2 co-pay as a non-panel claim. Meaning, your MWs don’t have to fork out a single cent.

Got more questions on PCP? Go to PCP FAQs to get your questions answered. Or if you prefer a personal touch, contact your designated AO.

Links to each AO:

About Mednefits:

Mednefits helps businesses take care of their employees with its automated, affordable, and accessible employee benefits platform.

Request to join Mednefits for free to help process and track claims in real-time, while controlling costs.